Greetings, Mike here. For some reason our Edinburgh office seems to be rather quiet today, so I’m in charge of TCWU…

Unless you’ve been living in a cave you’ve probably noticed there is a Budget due roughly this time next week. After what has surely been the longest lead in time in history, full of rampant speculation, finally we’ll get to find out what is actually going to happen.

I spent yesterday morning at the launch of Royal London’s Meaning of Value research. This is an annual study that we’ve supported for the last three years. You can download a copy of the report for free here and if you want to read some of the press coverage you can do so here, here, here and here.

The last one of those links carries a headline “Value of advice rises amid Budget uncertainty”, and this summarises nicely a couple of key findings from the report. The Meaning of Value, as the name suggests, has always been about identifying what it is consumers actually value when purchasing any product or service. As most people know, the only person who gets to truly decide whether something is or isn’t value for money is the person purchasing said product or service. This research shines a light on which aspects consumers factor into their minds when making this decision.

Over the three years we’ve conducted this research we’ve seen very little change in what consumers say is important to them when considering value. For financial services products or services consumers frame value less as a transactional concept (pure cost vs benefit) and more relationship-based, involving honesty, reliability, and fair returns. Trust and honesty, and service quality are more important than the actual price/fee being paid.

Whilst the above has remained static (and we expected it to do so), when we ask consumers who are paying for advice whether they think it was value for money we’ve seen year-on-year increases across the board. Asked to rate their adviser for overall value, 68% of consumers give net positive scores, compared to 66% in 2024 and 53% in 2023. Fewer than 5% say advice was not of value to them.

Increasingly a large part of this value is attributed to more behavioural based activities, providing reassurance during volatile markets and dealing with clients who are worried about the Budget speculation. The research shows advice firms starting to evolve over the last three years to be more planning led, and this is also what the research tells us consumers prefer. But for the Budget the workload has been extensive – 97% of advice firms we spoke with have had at least some client enquiries off the back of the Budget speculation.

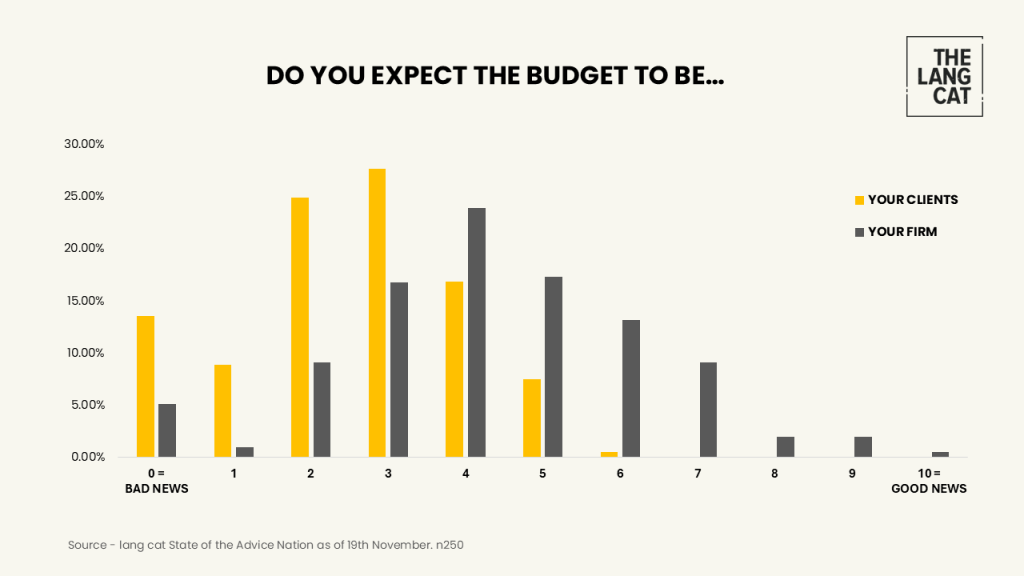

More recently, as part of our State of the Advice Nation survey we asked respondents whether they expect next week’s Budget to be good or bad news for their clients and their firm. Based on over 250 responses we can see advisers expect a busy time over the coming months as the impact of the Budget is finally known. Changes to personal taxation limits and legislation might be bad news for clients, but they create the need and opportunity for financial planning, and a chance for advisers to further demonstrate their value to their clients.

For your music choice this week – I shuffled onto this the other day and reminded myself just what an incredible voice she had. Enjoy some Amy…