The FCA has (finally) published its annual data dump for the advice sector, using data from 2024’s regulatory returns.

You can peruse the full dataset here, but for those with better things to do, here are a few highlights:

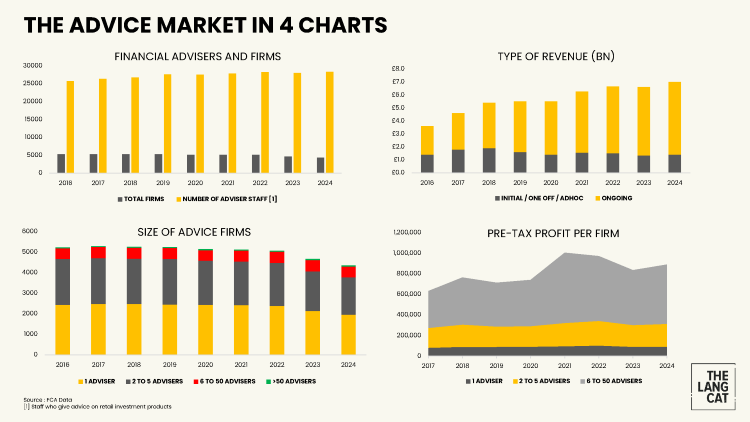

1) The number of financial advice firms has fallen noticeably over the last few years – 5,062 in 2022, 4,654 in 2023 and 4,340 in 2024.

2) The number of staff employed by these firms which are able to give advice on retail investment products has ticked up slightly from 27,941 in 2023 to 28,245 in 2024. Over half (15,016) of these staff are employed by firms with 50 or more advisers.

3) There are now 53 firms with over 50 advisers, up from 48 firms in 2023. All other firm size categories (1 adviser, 2 to 5 advisers and 6 to 50 advisers) have seen a year-on-year fall in their numbers.

4) The number of ongoing clients served by financial advice firms fell slightly from 3.559m in 2023 to 3.552m in 2024.

5) The number of initial advice services increased from a total of 820,028 in 2023 to 874,778 in 2024. However, this increase was only enjoyed by the restricted sector. Independent firms saw their initial advice numbers fall from 389k in 2023 to 367k in 2024.

6) Of the firms providing retail investment advice in 2024, 87% provided independent advice, while 12% provided restricted advice. Restricted firms generated 36% of adviser charges.

7) Despite the fall in the number of firms and clients being served, reported revenue from retail investment intermediation increased by 6.2% to £5.7bn in 2024, compared to 2023 (£5.4bn). Pre-tax profits for 1 adviser firms were broadly stable, but increased for firms with 2 to 5 advisers and 6 to 50 advisers.

That’s it for now – interested to hear any thoughts on the trends highlighted above.