The not-so-NISA sting in the tail

On the 1st of July, the whole world will tilt on its axis as swathes of Great British investors rush to top up their ISA allowance to a whopping £15,000. People are positively giddy with excitement at the freedom allowed them by Chancellor Osborne’s sweeping budget reforms. Not only can they invest more, tax efficiently, they can freely switch from a Cash ISA to an Investment ISA! AND BACK AGAIN, and no one will bat a regulatory eyelid. Good old Gideon.

But before we get too excited, there is a potential sting in the tail with this new freedom and flexibility.

You see, what we have in theory is a great structure within which my mum, for example, could bung a few thousand pounds into a Stocks & Shares ISA and then, a few months down the line, perhaps when interest rates begin their inexorable rise, send a wee online instruction to the platform provider of her choice, and hey presto, Cash ISA-a-go-go.

Except. Exit charges.

It’s hard to get to the bottom of what all providers have up their sleeves with regard to Cash ISA plans. However, from what I can tell, pretty much all of those that offer a Stocks and Shares ISA, don’t (and won’t) have an alternative Cash ISA available into which a seamless, hassle-free switch can be made. And the ones that do are unlikely to be able to compete on rates with the banks and building societies.

To be fair, there doesn’t seem to be much of an incentive to providers to develop a competitive Cash ISA alternative. To do so they would have to apply for a banker/deposit taker license and take on more risk. So I can’t see many rushing to develop an all-encompassing Super (N)ISA.

Yes – you will be able to switch between Cash and Stocks and Shares ISAs, however in practice, it’s going to be a pretty clunky, cumbersome experience, not to mention a potentially expensive one for those poor schmucks tied into their – We put the customer at the heart of everything we do! provider with exit fees. (Unreasonable post-sale barriers to exit or switch? anyone? ANYONE!?)

Things will be a whole lot cheaper for those customers of the, no exit fee – brigade (hats off to you guys). But, still I’d hazard a guess that the actual switching process will be enough of a pain to put many people off taking advantage of the new flexibility.

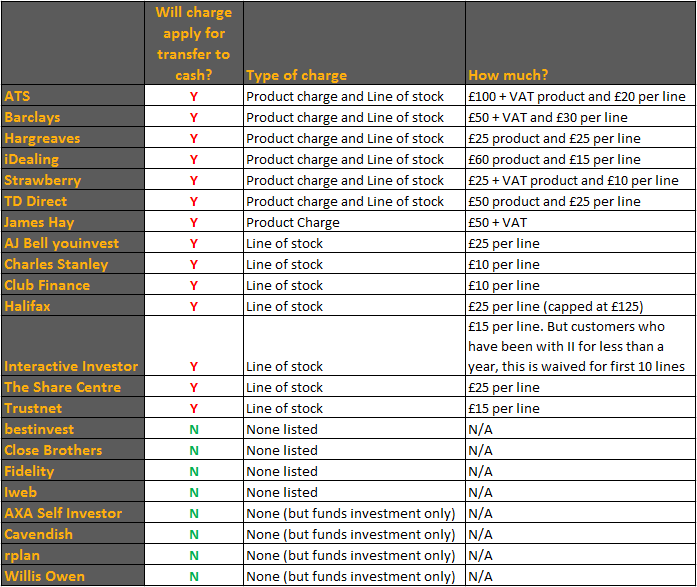

So, we went on a bit of a mission earlier today and had a good look through the various charging sheets for investment platforms. Now, this is based on our interpretation of their marketing brochures – and some of those are not for the faint hearted – but it’s absolutely clear that the actual cost of switching to a Cash ISA from these guys will vary greatly.

Runners and riders

What can we tell? Well, if you’re invested in funds then you’re probably ok in terms of back-door charges. Stocks and shares on the other hand are another matter. Transfer charges will range from zero for the handful who carry no charges (unless they’re not telling us!) to several hundred pounds if you’re invested in anything more than even a handful of lines of stock.

For direct investors, IT WILL PAY to do your homework.

So. Other than being able to invest more or your hard earned, there really isn’t much by way of flexibility or simplicity. Yet.

This is all a tad depressing, and I expect not what Mr Osborne had intended. It will be interesting to see how providers adapt their propositions to make the new ISA regime work for customers in the way it was intended.

If there are any providers out there scratching their heads, we have a few ideas!