It’s been, ooh, I dunno, weeks or something since a platform mucked around with its charging structure. So it’s with a sense of relief that we heard from our friends at Zurich last week that the Zurich Intermediary Platform – the only platform whose acronym is named after a clothes fastening – has stepped up and done the decent thing.

Now, when ZIP came out we gave it a bit of a monstering on the charges front (whilst observing that its non-standard front end was actually really nice). The structure as it stood could only have been designed by committee, with too many tier points and, unforgivably, charges to three decimal places. An example if ever there was of the numbers monkeys winning out over the needs of the customer.

Thankfully, with Zurich’s reprice, three decimal places are a thing of the past, and there are now fewer tiers as well. Some investors, especially at the lower end, will be quite a bit better off, and that’s a good thing.

This is all very timely, given TR 14/10 and GC 14/03 (the links go to the papers themselves; we’ll do a blog on these very shortly). Specifically, GC 14/03 recommends that information should be accessible to the most inexperienced self-investor. The research found that customers want small chunks of, ‘must know’ basics, in plain English and in a clear and consistent format so they can find what they need to know and make informed comparisons. Not exactly ground-breaking but a robust and timely reinforcement which we hope will lead to real change for the better. We suspect that charges calculated to the nearest thousandth of a percent don’t measure up.

OK, on with the show. Here’s what Zurich has done:

Prior to this we had 0.45% up to £50k and 0.325% (snark) between £50k and £100k.

It’s a basic tiered structure – no fixed elements, no caps, steps, or anything to mark it out from the norm. Family linking is available as long as the combined portfolios are over £200k. The SIPP (Retirement Account) has a £75 annual charge, but that’s waived for new investors before 5 January 2015. We’re not a fan of – new investors only – offers, but there we go. Cash is subject to a well-disclosed skim of 0.1% per annum. Trading is £10.50 a pop apart from big trades, if it moves Zurich will pretty much pre-fund it, and that’s about it.

So what do we think? First of all, once again we must just point out that this constant market adjustment shows that price does matter. It’s not the only thing, of course. We never claimed otherwise. But charging remains a key element of suitability and we expect to see this brought into sharp focus in the due diligence thematic review later this year.

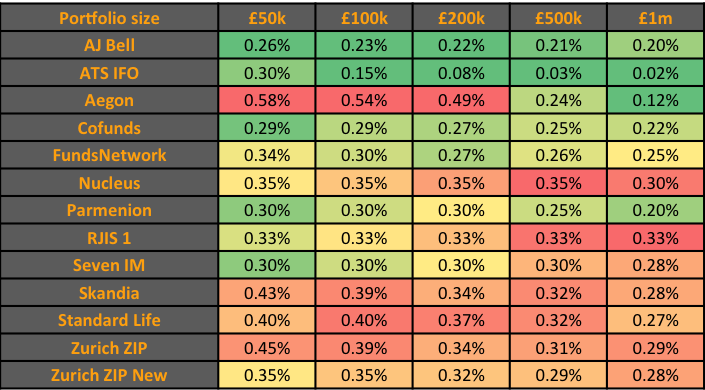

Let’s check the heatmaps (as ever in blogs, just a cut; subscribers get the full thing). ISA/GIA first:

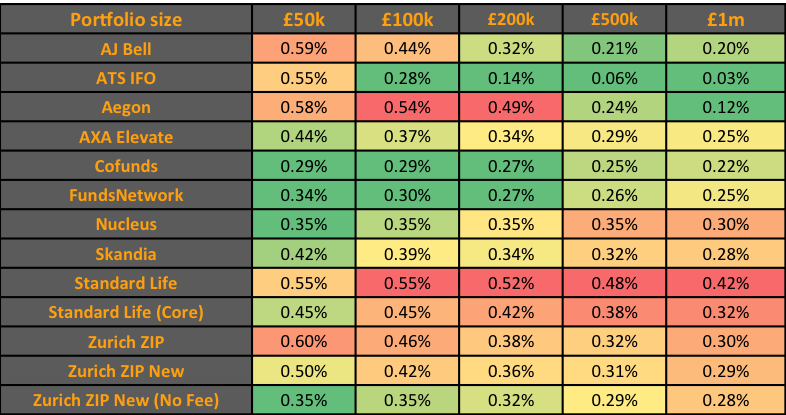

and now SIPP:

ZIP’s pricing is sort of unexciting now, which is probably what the guys were going for – fair enough. It’s on the market, not leading the market, and is basically unremarkable in most ways. It’s certainly harder to make jokes about, which is a bummer for us. So amber-ish mid-table positions all round, except for the no-fee period on the Retirement Account.

We know distributing through large intermediaries is a key part of Zurich’s skillset, and those deals are always done at custom rates around the industry. Book price isn’t that important. So we note a couple of things – it may be that getting support from more regional firms is increasing in importance. And the trimming at the bottom end from the old shape is useful – with average platform holdings well under £200k across the market, this remains the key battleground and the one where ZIP has made the biggest change.

Not much more to say really; the market continues to close up, and those providers – ZIP included – who stress – value not price – will really need to work out how they differentiate their propositions. Those who can will be able to resist commoditisation and resultant price pressure. Those who can’t – we all know how that goes.