On Friday past, the gaffer shared his thoughts on the difficulties facing new entrants to the already stacked D2C market. In it, he alluded to details of a new entrant emerging any day now. Well, today Aviva has launched its platform for consumers, cryptically named the Aviva Consumer Platform.

The platform is powered by FNZ and offers access to a dealing account, ISA and pension together with both fund and equity investment. Let’s look at the charges first and we’ll talk about other stuff in a bit;

- Aviva have gone for a tiered ad-valorem (posh -> percentage) structure. First £50k costs 0.4%, next £200k at 0.35%, the following £250k at 0.25% and no charges above this.

- In simple terms, this equates to a charging cap of £1,525 per year because arithmetic.

- This applies across dealing account, SIPP and ISA with no further core wrapper charges or GYMBOA[1] costs

- Fund switching is bundled in. Equity trading costs £7.50 a pop.

- No exit fees at all for product closures or transferring out. That’s a fist pump in our book.

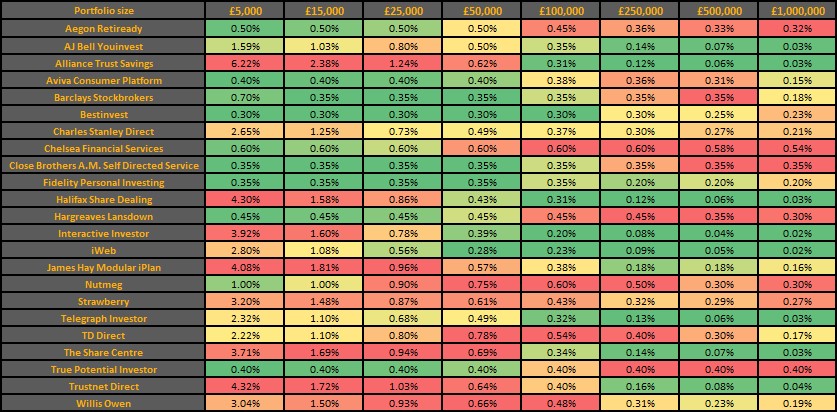

I’ve wiped the stoor from our D2C platform engine and programmed in the charging structure. Let’s see how this all translates to our heatmaps. Usual assumptions apply. We look at investment in funds, ongoing platform and wrapper charges (with the exception of the initial £200 fee to open an iWeb ISA, too large a fee to ignore) plus the cost of 5 switches (5 buys and 5 sells).

We have equivalent tables for equity investment, just drop us a note if you’d like them too.

SIPP first:

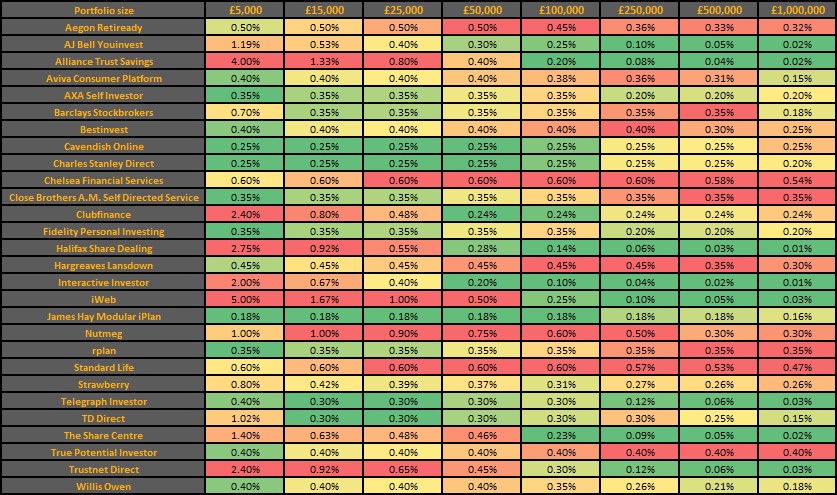

And ISA/GIA:

So, from a charging perspective;

- Your cost of entry if you have more modest funds is very competitive. 40bps stacks up well against those with fixed costs or those who charge extra for fund switching

- Lack of SIPP wrapper costs in particular makes it an extremely attractive option for anything up to around £50k.

- For pretty typical pot sizes (10-20k in ISA and 100k in SIPP), Aviva are a gloriously on-brand yellow hue. We hope this is deliberate.

- We’ve not featured the equity tables here but the £7.50 trading charge is competitive compared to most peers who charge around the tenner mark. However, lots of these peers carry no core custody charges so the net effect is much of a muchness.

All in all, from a cost point of view there’s little to disagree with here. A relatively simple charging structure (although we’d prefer fewer tiers) with no extra costs for drawdown or transferring out gets a thumbs up.

We do find the fact that the entry charge for a D2C ISA with Aviva is 60% higher (25bp compared to 40bp) than that on its adviser platform a bit weird. A bit like Tilney BestInvest charging more for an ISA than SIPP, it’s just one of those things that doesn’t feel right.

Also strange is the fact that the platform is powered by a different underlying kit (FNZ) compared to its advised wrap (Bravura). I’d question how sustainable this is going forward? For example, how efficient can it be to have to respond to regulatory changes across 2 different pieces of kit? Will be interesting to see how that pans out.

We’d love to look at the proposition itself in a bit of detail but given that Aviva are soft-launching it’s difficult to go into any depth at present. Info is a bit on the light side and is a bit lost within the sheer scale of the Aviva website. We would hope and expect something a bit more flavoured and distinct to show up in the coming months.

At lang cat HQ we’re currently in the process of writing our annual (free) guide to D2C investment. Once the Aviva platform is launched properly, we’ll be opening an account and reviewing in one of the quarterly updates that follow.

Till then, I share the boss’s scepticism when it comes to a new entrant to the market gaining any immediate traction. We see lots of propositions, some of which genuinely well articulated, in this market struggle to gain meaningful AUA and I suspect Aviva will need more than just brand reputation and financial strength to succeed here.