The platform market is maturing and a natural by-product of this is increasing merger and acquisition speculation. This, along with ever improving due diligence practice, has brought the issue of platform financial strength and performance into sharper focus. Overall, this level of analysis is a good thing because adopting a platform that goes belly up or significantly changes focus could prove to be a rather costly pain in the rear end for an advisory business.

Of course, anyone who spends time buying or selling companies will tell you that straight-up on-paper financial performance is only a crude indicator of long-term financial viability. It matters, but as part of a bigger picture.

That bigger picture is where you live – in the real world, where you have lots of competing requirements. So priority comes heavily into it. Strong profit performance might be the number one concern for Adviser Kate, yet scale of a parent company or AKG rating might matter more for Adviser John.

Financial health is also a messy thing to assess. Independent wraps like Novia, Nucleus and Transact are easier because they all report accounts that clearly apply to the platform. Life companies and some of the former fund supermarkets are a different herd of cats. There’s a host of different business models and in some cases the platform is so heavily embedded into the overall company accounting that it’s impossible to extract properly meaningful data. There’s also the issue of how services are charged between different companies in a group, meaning that the platform can bear the cost of group services and be artificially held back from making a profit, if that suits the accountants.

WE NEED TO RELY ON SOMETHING THOUGH

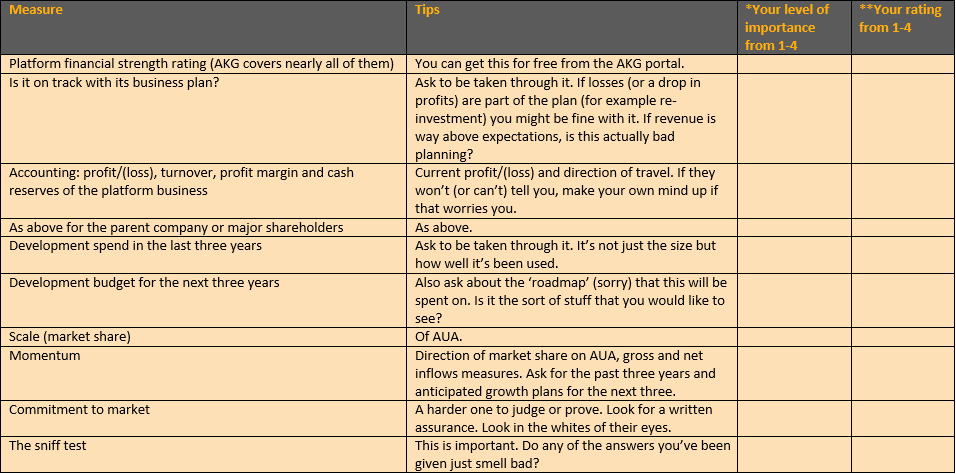

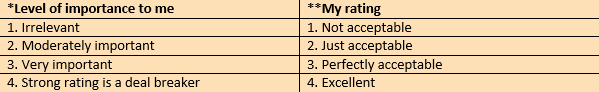

You do, and here is my proposal for a wee checklist that might help. Add and delete from this as you like, these are just my suggestions. Some of this can be researched (for example via Companies House) but asking the platforms as part of your due diligence process is a good place to start.

If a copy of these tables in word format is any use to you, click here Turnover-is-insanity-profit-is-profanity-tables-only

You can interpret the results in a number of ways. If any measures that you deem to be a 4 in importance rate as a 1, it’s likely to knock that platform off the list. You can also do this in a matrix to produce overall scoring, spitting out a ranking of those that have the best match based on your own criteria.

And just to be really, really clear before anyone gets mardy: BUSINESS PERFORMANCE IS ONLY ONE AREA OF DUE DILIGENCE. I’m not suggesting for a second that people go about picking platforms based purely on it. In reality, assessing this stuff is often more about verifying that selections based on proposition have no business performance issues that will scare you off.

Something that is unsuitable for your clients but financially rock solid is still unsuitable.