Over recent years I’ve heard many folk opine how the advice sector should no longer be viewed as an industry, but a profession.

Intuitively it has always felt like this view was increasingly justified, not least since I’m old enough to remember the “good old days” of pre-RDR. The long-awaited output from the FCA’s thematic review of retirement income advice is, however, an opportunity for the advice sector to prove this point, both by embracing the good practice examples that are shared, but also stamping out the poor practices still sadly displayed by (thankfully) a small minority of firms.

Hitting their ‘end of Q1’ deadline with an impressive six working days to spare, the FCA has not only released the findings from said review, but packaged them up with a Dear CEO letter, a ‘Retirement Income Advice Assessment Tool’ (RIAAT) and some guidance on how cashflow modelling tools should be used. There is lot to enjoy here, if that’s your thing.

A pleasant contrast

And here’s the thing – reading it all I think there is a fair amount that the advice sector should enjoy.

Yes, it is a “mixed picture”, and some of the poor practice examples do indeed look pretty poor, but the FCA’s own findings show that these firms are in the minority.

The wealth management and stockbroking sector was warned in November that “our supervision will become more targeted, intrusive and assertive”. By contrast, the Dear CEO letter the advice sector has received today is actually quite pleasant and constructive. Any profession should always be looking to constantly improve the outcomes they are delivering, and the findings from the FCA will allow advisers to do exactly that.

As with pretty much everything these days, Consumer Duty is the answer to whatever questions are thrown up.

It would have been astonishing to find that the FCA had concluded from this review anything other than the new rules they implemented last year are indeed fit for purpose, but at the time of the review work was needed to meet the new standards.

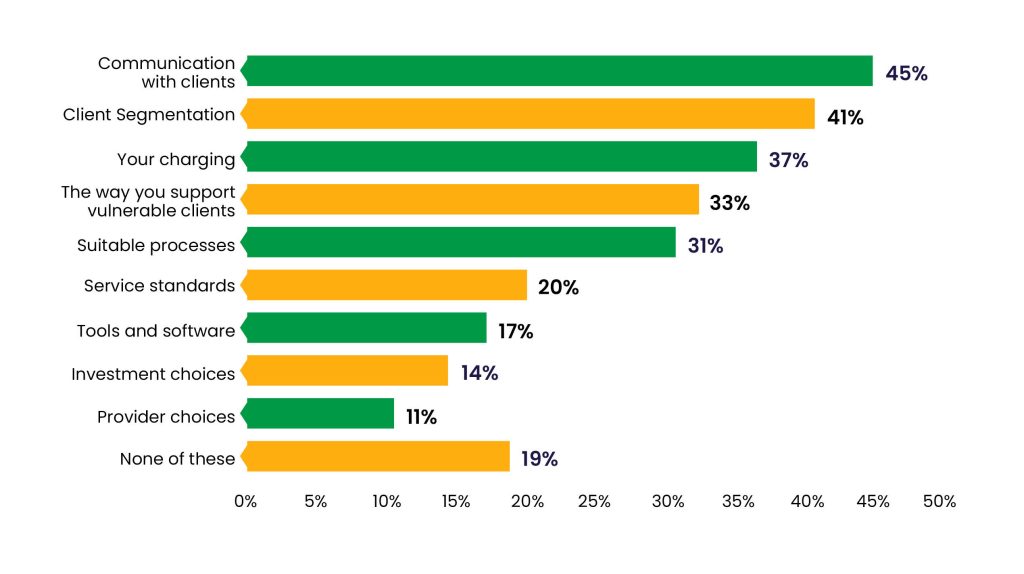

As the review highlights, the FCA study was completed before Consumer Duty was implemented so is perhaps a bit of a moving target. Our more recent research, conducted in Q4 last year shows that four out five advice firms have made some tangible changes as a result of Consumer Duty.

Figure 1: Source, State of the Advice Nation 2024

WHICH TANGIBLE CHANGES HAS YOUR ORGANISATION MADE TO MEET THE CONSUMER DUTY REQUIREMENTS?

The CRP issue

There has been much debate over recent years as to whether advice firms should run a dedicated centralised retirement proposition (CRP), separate to their investment proposition. This review thankfully puts that discussion to bed.

Whatever you are doing, you need to have it fully documented. You need to ensure you deliver both consistent outcomes as well as ensuring individual client suitability, and you need to ensure everyone involved is trained on how said thing should be used. What’s more you need decent systems and controls to ensure everything is working as intended.

Taking it back to Consumer Duty, we know from the work we’ve done with advisers the target market definitions are the critical part to get right. If these are well thought through, everything else (price and value, consumer understanding, monitoring etc) will fall off them.

But as the FCA’s work highlights, over half of firms hadn’t clearly defined their target clients. Whether you are running a CIP/CRP/something else, investing time on getting your target market definitions nailed is time well spent.

The use of risk profiling and cashflow modelling

Elsewhere we get several reminders about how risk profiling and cashflow modelling tools should be used, harking back to final guidance published over 10 years ago.

While these papers are still sound and were well received when they were originally published, I do wonder whether they could do with a refresh to bring them up to date.

Both the risk profiling and CIP final guidance papers are over 12 years old now, and both were (obviously) written before pensions freedoms was a thing. It is, however, astonishing to find within the FCA output a handful of poor practice examples where these papers are not being followed. Most decent advisers I know have these two papers committed to memory.

This takes me back to my main conclusion from reading all of this.

As one adviser I spoke with this morning said – “this is really basic stuff”. The poor practice examples back this view up.

Missing files, not being able to evidence service delivery, research/due diligence for planning tools that consisted of going to a conference to decide what tools to use all are indeed basic errors that a profession really needs to stop making.

The decent advisers I know will embrace this report and learn from the good practice examples. They will also be encouraged to see the regulator taking action against the poor practice firms whose actions sadly impact the reputation of the sector as a whole.

__

For more from the lang cat on regulatory and public affairs, stay up to date with our Tracker service. Advice professionals who subscribe to Analyser get this as part of their subscription, for everyone else you can find out more here.