I would have got away with it too if it wasn’t for those meddling KIIDs

The cat is officially out of the bag (not that we condone cats being in bags). One of the changes ushered in at the start of the year by the beast that is MIFID II is the requirement for fund groups to disclose the additional transaction costs that are charged to their funds, on top […]

MIFID reality check

So, happy new year and all that. First full week back. Yay. Whilst everyone was off eating/drinking/bravely battling #manflu (delete as appropriate) the investment industry got on with the small matter of the implementing MIFID II. For a lot of folk this was a huge project, described to us yesterday by someone who had lived […]

Aviva and Wealthify make a bold fashion statement

It’s been an interesting week in robo-land 1. On Monday the latest set of accounts for Nutmeg were published. As has become the norm, alongside the frankly hilarious boast of ‘an 80% market share’ the rest of the numbers were brutal. £2.56m turnover, £11.9m operating expenses, and a loss of £9.3m (on top of the […]

YOLO, but for a long time hopefully

I’ve just finished reading a blog from Natalie Tuck at Pensions Age: YOLO vs retirement, which argues that ‘regardless of which generation you are born in, when you are young, you have other priorities than saving for retirement’. First up, I need to declare an interest: Alliance Trust Savings is one of my clients, so […]

WHAT NO LISA?

The lang cat’s Platform Market Scorecard was released to subscribers last week. You can read more about it here, but we want to take you through a couple of findings from this quarter’s smorgasbord. In each quarter, we take a detailed look at one area of platform propositions. This quarter, because it’s so topical, we’re […]

Groundhog Day (but with less rodents and more platforms)

Another day, another FCA paper, this time the snappily titled Investment Platforms Market Study Terms of Reference (MS17/1.1 to its mates). We’d heard talk of a deluge of regulation arriving once the FCA emerged from purdah and, since 21 June when the DB transfer consultation was published, we’ve now been treated to almost 500 pages […]

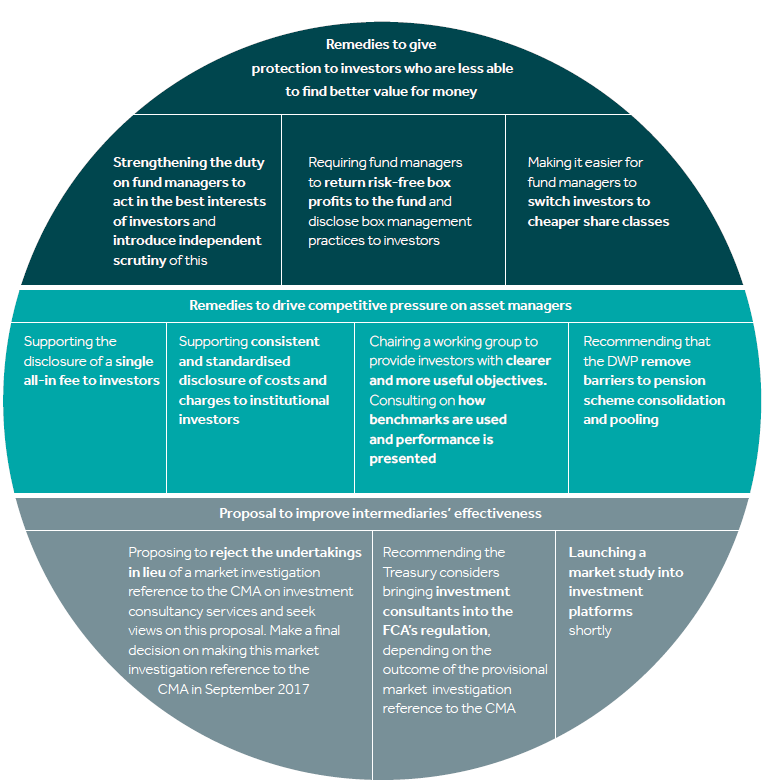

The FCA’s difficult second album

When the first release is so good there is always a danger it will be difficult to maintain momentum and replicate the raw excitement second time around. The FCA’s Interim Asset Management Market Report, released last year, on a cold November Friday morning (with far less fanfare than today’s publication) was an incredible read – […]

THE DAY PENSIONS GOT EDGY

Yesterday, over 200 pension-world glitterati gathered at Peterborough Showground in front of a sterling cast to debate the big issue in pensions today: DB to DC transfers. It was absolutely roasting. There was energy in the room. There were arguments. People were wearing shorts. I wished I was wearing shorts. Before I go any further, […]

That’s not a moon. That’s a space station. Vanguard launches; the Rebellion weeps.

After much market rumour and anticipation Vanguard have lifted the covers on their direct offering for the UK market. With The Sunday Times helpfully writing an advert for them over the weekend it certainly appeared that the launch was imminent, and finally the big day has arrived. First reactions? It’s cheap. Seriously so. The account […]

ISA ISA BABY

Last week saw the latest release of ISA stats from HMRC. These figures come out every 6 months or so, and against a backdrop of the household savings ratio being at a generational low they don’t make pleasant reading for anyone involved in the investment industry. Over the last year, £120 billion was put in […]