E-I-E-I-Oh, not that kind of FAMR then

We’ve already taken a light touch (ahem) look at the FAMR report overall but, in among all the consultations and not consultations and the stuff that is actually going to happen but will take time and the fact that aspects might get upended by MiFID II at some point over the next 18 months, lies […]

CHALLENGE, ACCEPTED

The first challenge of the FCA’s TR16/1 Assessing Suitability: Research and due diligence of products and services was trying to work out what had happened to the rest of it. The industry has been watching and waiting for, oh, ever to hear the FCA’s glad tidings on all things due dil. And what did we […]

If you wannabe my Robo

It will probably come as no surprise to you to hear that Leith’s leading platform and investment consultancy * are doing a fair bit of work at the moment in the exciting area of robo advice. Firms large and small want to understand what is going on, where the opportunity might be, and crucially what […]

Back once again

Back once again (with the ill behaviour?) In a move that will shock no one it has been reported that Santander & RBS head the lists of banks returning to the investment advice market. With several other large institutions rumoured to be planning similar moves it seems that the post RDR period of the banks […]

Tales from The Crypt

Dearly beloved. We are gathered here today To quote Shaun Sandiford of Octopus, “man that was good“. A HUGE thank you to everyone who came to #langcatdeadX, deep down in the Crypt on the Green. Briefly, because we know you are busy and all that, here are just some of the highlights! For some reason […]

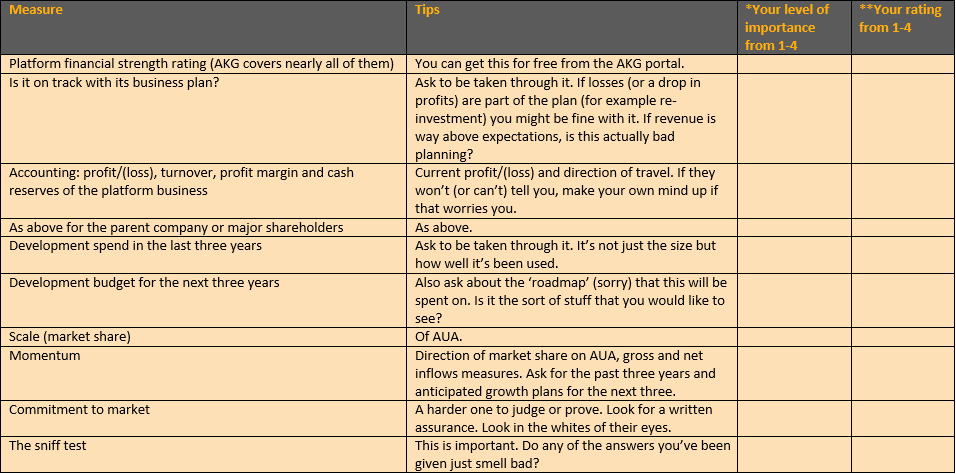

TURNOVER IS INSANITY. PROFIT IS PROFANITY.

The platform market is maturing and a natural by-product of this is increasing merger and acquisition speculation. This, along with ever improving due diligence practice, has brought the issue of platform financial strength and performance into sharper focus. Overall, this level of analysis is a good thing because adopting a platform that goes belly up […]

The exciting ever changing world of platforms

The exciting ever changing world of platforms. The current state of the UK platform market is as exciting as it’s been for a long while, and in our view there are some hugely significant changes taking place. Over recent weeks we have seen a number of platforms being rumoured as being up for sale, and […]

What should we do about sequence risk?

Sequence risk has been a hot topic lately and with recent market volatility questions of post-retirement portfolio construction are at the forefront of advisers’ minds. However, new research from CWC Research produced for the FE Investment Summit later this month, finds adviser attitudes towards sequence risk and its management within retirement portfolios vary widely across […]

What will September bring?

If there is one thing I’ve learnt during 20 years in financial services, it’s that August is traditionally a quiet month. Everyone goes on holiday and then frantically crams in two months work into September. Already I can feel the September surge coming through, but this time it feels different. Quite a lot did happen […]

It’s all in the game

One of the most iconic scenes in The Wire is the court room scene where Omar, a character who has a penchant for murdering drug dealers, is being cross examined by an especially slimy prosecution lawyer. After a couple of minutes of the lawyer lambasting our hero for living off the drug trade and creating […]