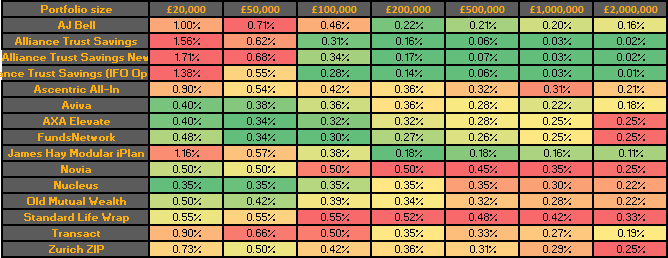

No escaping basic arithmetic – all about the ATS price changes

As 2016 breathes its last, we are plagued, sorry, blessed by a mini-flurry (Worst. Flurry. Ever.) of pricing changes from platforms. Last week we had Elevate / SL; this week it’s our Dundonian friends, Alliance Trust Savings. ATS is increasing its fixed fees on both direct and advised business, but offsetting that in part with […]

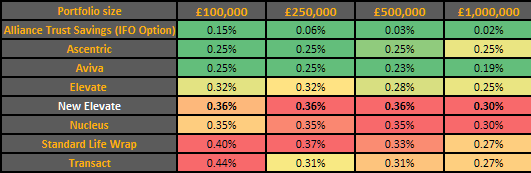

What’s 0.04% amongst friends? Standard Life hikes Elevate prices; causes eyebrow raising in Leith.

I’ve always liked folk who buck trends. Counter culture is my favourite kind of culture. So you’d think I’d be supportive of Standard Life’s decision to buck the downward trend of platform pricing by increasing Elevate’s charges. And in some ways I am. In others, though, I’m not, and I’ll tell you for why. It’s […]

D2C’s big CPA day out: Nutmeg’s results and Vanguard’s plans

HEALTH WARNING: We’ve had some fun guessing at Nutmeg’s figures in this blog. Our guesses are just that, and we don’t make any claim for their accuracy. We’d love to have accurate figures, but until we do please treat any figures in red as (hopefully) interesting, but no more than that. If you’re interested in […]

Slurp! Aegon eats Cofunds for BREAKFAST

(Journos reading this, any part of it is attributable if you want it.) So before we get into this, I need to tell you that the lang cat has been doing a wee smidge of work here and there on matters pertaining to the acquisition (posh) so if that bothers you, stop reading now. If […]

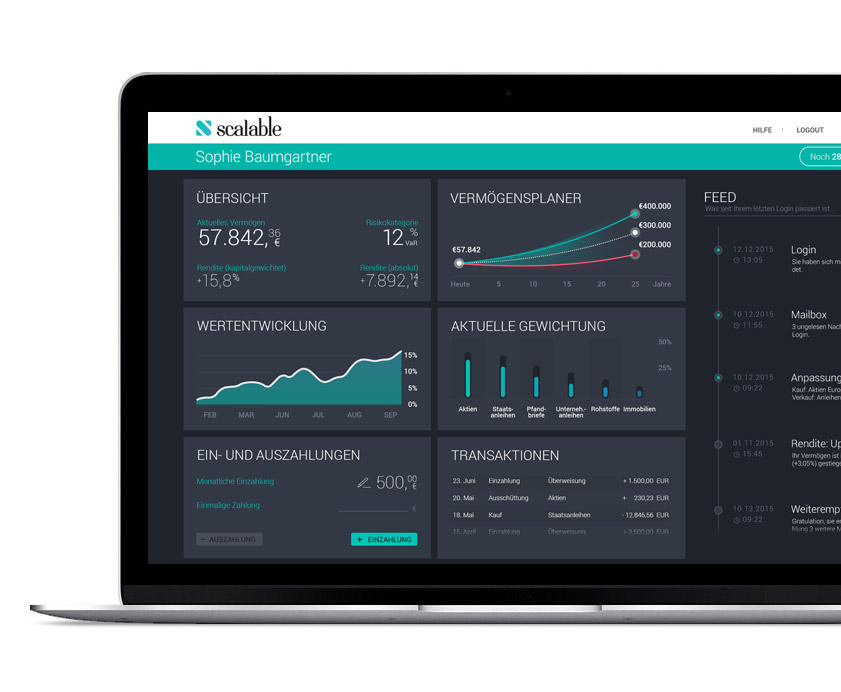

A (slightly resentful) welcome to Scalable Capital

So you go off on holiday, all happy because your new guide to direct platforms and robo-advice has launched. You come back, and some rotten sod has gone and launched while you were away and spoiled all your tables and that. The rotten sod in this case is Scalable Capital. To be fair, we’ve known […]

And so it begins – Standard Life scarfs AXA Elevate

(I made edits to this at 7.30pm on 4/5/16 to update on the Architas deal, pricing reviews and the purchase price). Well, I was never going to be able to let this go by. I was on a plane as I wrote most of this; the news of Standard Life buying AXA Portfolio Services, which […]

Aviva and FNZ up a tree, R-E-PLAT-FORM-I-N-G

Just a quick few thoughts on the news from Aviva today that it plans to migrate its platform from Bravura to FNZ. For those not intimately involved, Bravura and FNZ, along with GBST (disclosure: GBST is a client of ours) are the three big beasts of outsourced platform technology in the advised space. IFDS is […]

Booting ISAs in the baws – tax year end 2015/16

Well now, the IA has just put out its stats for tax year end (TYE) 2015/16 and it’s not nice reading. The full release is here but this table which I nabbed from the release tells quite a story. 2014/15 was generally reckoned to be a relatively sucky year for the ISA season, which has […]

FAMR: we call bullshit

FAMR could have been huge. It could have been beautiful. It could have been the equivalent of three lines of really good crank washed down with a triple espresso for the good end of the advice profession. It could have done so much. But it didn’t. Instead, what we got was 80-something pages of prevarication, […]

Bow before the power of arithmetic: ATS ups charges

So we haven’t had any large price changes for a while, hence no pricing blogs. A debt of thanks, then, to Alliance Trust Savings (ATS) who upped its fixed fee charges last week along with unveiling its results (find Citywire coverage of those here) and rolling out its new GBST-powered system to users. Now, before […]