Groundhog Day (but with less rodents and more platforms)

Another day, another FCA paper, this time the snappily titled Investment Platforms Market Study Terms of Reference (MS17/1.1 to its mates). We’d heard talk of a deluge of regulation arriving once the FCA emerged from purdah and, since 21 June when the DB transfer consultation was published, we’ve now been treated to almost 500 pages […]

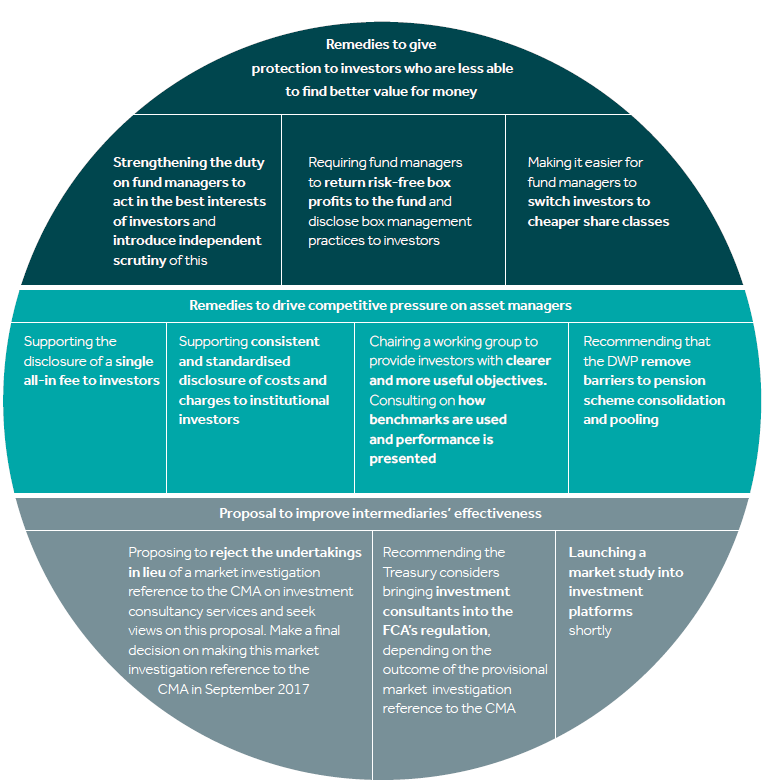

The FCA’s difficult second album

When the first release is so good there is always a danger it will be difficult to maintain momentum and replicate the raw excitement second time around. The FCA’s Interim Asset Management Market Report, released last year, on a cold November Friday morning (with far less fanfare than today’s publication) was an incredible read – […]

A WORD TO THE (HUB)WISE

It’s been ages since I’ve written a pricing blog. It’s also been a decent chunk of time since we’ve seen a new entrant to the advised platform market. A glorious piece of serendipity then to see that Hubwise has (re)launched[1] its advised proposition and given me reason to get the Casio out. Those who monitor […]

IS IT ME OR IS IT GETTING HOT IN HERE? SCALABLE CAPITAL & INVESTEC’S BIG DAY

Well, after a period in which all the talk was of funding moving away from robo-advice to ‘insurtech’ and ‘regtech’ and other things ending in ‘tech’ that neither you nor I understand, BlackRock and Scalable Capital have come from nowhere and given us all plenty to talk about. (Before I crack in, a bit of […]

THE DAY PENSIONS GOT EDGY

Yesterday, over 200 pension-world glitterati gathered at Peterborough Showground in front of a sterling cast to debate the big issue in pensions today: DB to DC transfers. It was absolutely roasting. There was energy in the room. There were arguments. People were wearing shorts. I wished I was wearing shorts. Before I go any further, […]

That’s not a moon. That’s a space station. Vanguard launches; the Rebellion weeps.

After much market rumour and anticipation Vanguard have lifted the covers on their direct offering for the UK market. With The Sunday Times helpfully writing an advert for them over the weekend it certainly appeared that the launch was imminent, and finally the big day has arrived. First reactions? It’s cheap. Seriously so. The account […]

ISA ISA BABY

Last week saw the latest release of ISA stats from HMRC. These figures come out every 6 months or so, and against a backdrop of the household savings ratio being at a generational low they don’t make pleasant reading for anyone involved in the investment industry. Over the last year, £120 billion was put in […]

SUB-DATAGASM! NEW TECH MARKET SHARE FIGURES RELEASED!

Hello, you. Right, further to our lovely infographic from the other week, we need to update the tech provider projected market share figures. While we’re at it, we took the time to really make some additional changes and widen the set to give a fuller view of the market. We’re still not breaking it down […]

OMG, OMW! WHEN REPLATFORMING ATTACKS.

One of the running sores of the platform industry, for a long time, has been replatforming. This is a typically abstruse[1] term coined by the industry for moving the underlying assets on a platform from one technology firm to another. Sound simple? Well, itâ’s not. I’ve been fond of saying for a while that ‘there […]

COVERT CONSULTATION COMPLICATIONS

I’ve been reading about Kim Philby lately, the so-called Cambridge Spy who fooled the British Intelligence Service for decades as he passed information to his KGB handlers. Secrecy, covering his tracks and passing communications in a manner that meant they would go undetected by all but the intended recipient were all in a day’s work. […]