So we haven’t had any large price changes for a while, hence no pricing blogs. A debt of thanks, then, to Alliance Trust Savings (ATS) who upped its fixed fee charges last week along with unveiling its results (find Citywire coverage of those here) and rolling out its new GBST-powered system to users.

Now, before we begin I need to disclose that ATS is a client of ours, and we’ve known about the planned changes for a little while, but been under non-disclosure until the announcement went public. So we’re about as conflicted on this as it’s possible to be.

As a result, I’m going to stick to publishing new pricing tables here, or at least excerpts of the full tables. If you want the full bhuna you’ll need to subscribe, which you can do here. Subscribers will get said bhuna at the next Update, which’ll be in April sometime.

What I will say is that it’s the nature of fixed fee propositions that they go up over time. Percentage-based providers catch more as client assets grow, but a £150k ISA is worth the same as a £20k ISA to any fixed fee provider.

How you feel about this particular price rise is up to you? it’s a 20% or £15 bump to the pay-as-you-go shape for ISA and GIA, and 15%-ish or £30 for SIPP. The Inclusive Fee Option version (IFO, which includes 25 trades) and kiddie accounts aren’t changing this time. Direct accounts are the same, except direct clients can’t access the IFO.

| Standard Account | New annual total | Old annual total |

| ISA | £90 | £75 |

| Investment Dealing Account | £90 | £75 |

| Junior ISA | £40 | £40 |

| First Steps Account | £40 | £40 |

| SIPP ‘Savings Account | £180 plus VAT (£216) | £155 plus VAT (£186) |

| SIPP Income Account | £255 plus VAT (£306). | £230 plus VAT (£276) |

| Child SIPP | £80 plus VAT (£96) | £80 plus VAT (£96) |

For reference, the IFO accounts are £150 for IDA and ISA, £275 for SIPP and £365 for drawdown. Given trading is £12.50 a trip, you’re getting over £300 worth of trades for £60, so IFO looks to be the way to go.

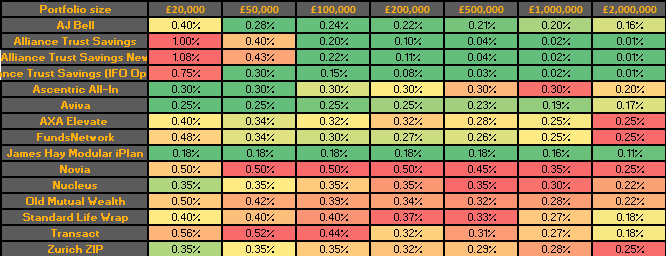

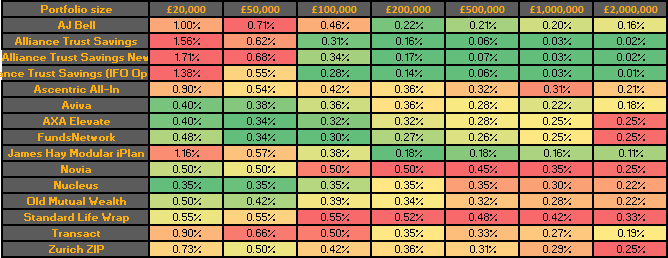

ATS table time (SIPP first and then ISA/IDA):

And, unsurprisingly, what we find is that arithmetic still has its day, and flat fee still looks pretty hot at £200k or more for SIPP and £100k or more for ISA/IDA. The bump moves the base at which ATS takes over the lead in the charts, but that’s not surprising.

If you are holding multiple wrappers then you need to factor in the fact (what?) that this is all per-wrapper charging, but otherwise it’s as you were.