As a business, Canada Life is largely geared around retiring and retired customers. It provides services and products such as drawdown, annuities, equity release, trusts and inheritance tax planning.

One of its concerns was around the effect that the money purchase annual allowance (MPAA) was having on its customers’ capacity to save.

The issue was that people were inadvertently triggering the MPAA by retiring and taking some flexible benefits, then wanting to go back to work and perhaps contributing to their pension only to get caught out with an unexpected tax charge.

Even without the tax charge, people were finding they were unable to replenish their savings once they’d started to access their money.

Canada Life was also concerned about the impact of the pandemic, and how the MPAA was affecting people who had left the workforce over the past couple of years, and who then wanted to go back to work and rebuild their savings.

As a result, Canada Life felt this was an important issue to campaign on. At the same time, it was a good topic for the chief executive Lindsey Rix to speak out about.

The company wanted to work with the lang cat on the lobbying side of things, and for us to provide some PR support. It not only wanted to make the arguments, but to be seen to be making the arguments.

Influencing change

We very quickly agreed that the priority was to put a Budget submission into the Treasury. It’s part of the team’s role to be tuned into the cycles of regulatory and public affairs, and at the time the deadline for making a submission was only two weeks away.

The timing was such that with the Budget coming up, this was the ideal moment for the rules to be changed.

We spent the time ahead of the deadline bringing all the arguments together.

While the timescales were tight, we were able to put together a detailed submission based on our knowledge of the policy detail and its nuances, the changes made since it was introduced, the logic from the Treasury in bringing in the MPAA in the first place, and how the policy had gone down with the industry.

As well as sending in the Budget submission on Canada Life’s behalf, we drafted accompanying press releases and generated media coverage off the back of these.

A collective voice

The other thing the lang cat was uniquely placed to do was identify that Canada Life was by no means a lone voice on this issue. There were other industry participants who felt the same way.

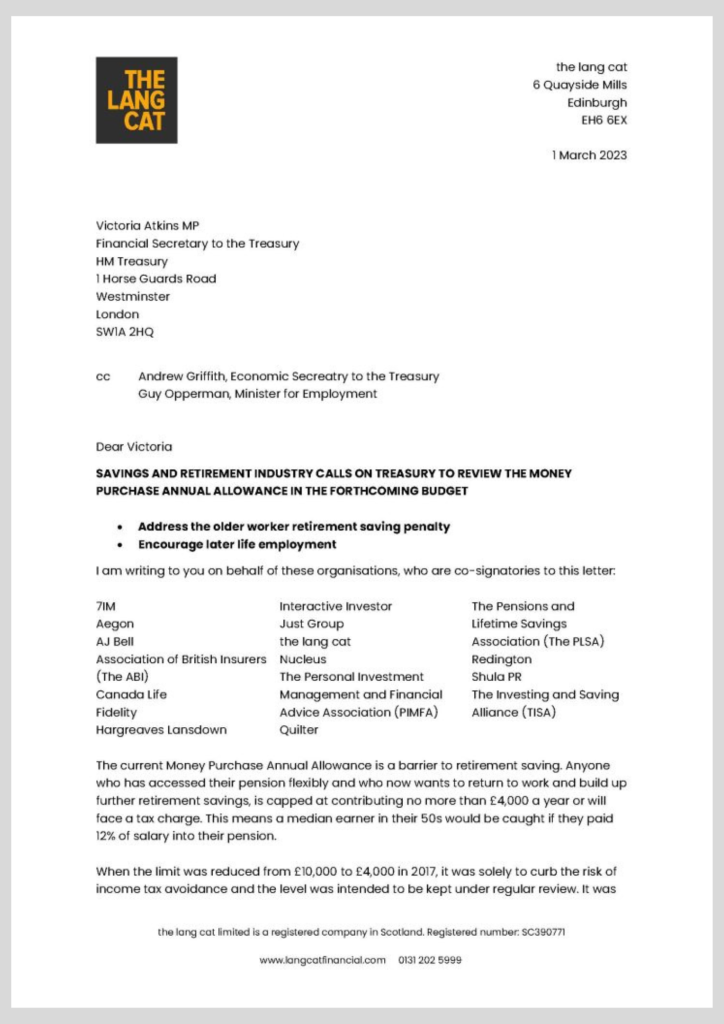

So we used our industry contacts to approach other stakeholders, such as platforms, insurers, mastertrusts and trade bodies about whether they would be prepared to sign a joint open letter to the Treasury, alongside Canada Life.

By making it a collective action, with the whole industry making the case to the Treasury, we knew that policymakers were much more likely to make a rule change if everyone was lined up behind it.

So we co-ordinated that coalition of support. We drafted the letter and submitted it to both the Treasury and the Department for Work and Pensions.

In all we secured support from 18 institutions, including trade bodies such as the Association of British Insurers, the Pensions and Lifetime Savings Association and the Personal Investment Management & Financial Advice Association. So we were able to get the backing of a big cross-section of industry representation.

We generated more publicity around the open letter, and lo and behold, come Budget day, the government made the rule change we were asking for.

We can’t say we definitely made the difference here, but we certainly helped.

You rarely win battles so quickly with public affairs, and some things can take years to play out. But it’s a good example of running a short campaign where we were engaged for three months, and we were able to deliver what was asked of us.

The end result

It’s true to say other people could have written the Budget submission, if they knew their way around the pension system enough in order to craft the relevant arguments.

Other people could have penned the open letter and got other people’s support. But they would need to be able to draw on a good range of industry contacts to do that.

Our work with Canada Life really demonstrates how the lang cat and my role as director of public affairs made the difference in a way few others could.

From Canada Life’s perspective, it got the exposure it was after and the lobbying was a success. Both the policy team and the PR team at Canada Life came out of the project looking pretty good, and we helped deliver a quick win on the policy change. For us, that’s mission accomplished.

Tom McPhail is director of public affairs at the lang cat