I spent most of this morning attempting to read and absorb the FCA’s PS14/9 Review of the client assets regime for investment business: Feedback to CP13/5 and final rules. I

Catchy title. Just a short update to confirm a couple of, you guessed it, changes to on-platform pensions. Following Fundnetwork’s recent removal of drawdown charges and then changes to the

Catchy title. Just a short update to confirm a couple of, you guessed it, changes to on-platform pensions. Following Fundnetwork’s recent removal of drawdown charges and then changes to the

(apologies for nicking Mark L’s headline. Maniac dictator’s privilege) So as you read this, there will be excitement, feigned or otherwise, about who is or isn’t getting Mr Woodford’s Famous

(apologies for nicking Mark L’s headline. Maniac dictator’s privilege) So as you read this, there will be excitement, feigned or otherwise, about who is or isn’t getting Mr Woodford’s Famous

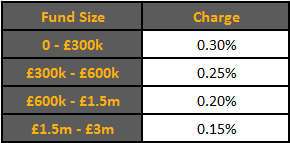

Here at the lang cat port authority we’ve been receiving quite a few questions on the much hyped forthcoming Woodford fund launch. What’s the cheapest platform on which investors can

Here at the lang cat port authority we’ve been receiving quite a few questions on the much hyped forthcoming Woodford fund launch. What’s the cheapest platform on which investors can

Today (13 May 2014) The FCA published the outcome of a thematic review into how fund charges are presented to customers. I encourage you to read it here. It’s only

Today (13 May 2014) The FCA published the outcome of a thematic review into how fund charges are presented to customers. I encourage you to read it here. It’s only

Recently I’ve found myself looking at D2C platforms. Partly for work stuff and partly because of a nagging feeling that I really ought to be investing in a share class

We provided the research for a report, in conjunction with Parmenion, which reveals how far short of expectations many adviser platforms are falling. The research found that over the last 12 months, 88% of advisers needed to apologise to at least one of their clients on behalf of a platform, and that poor service delivery from platforms impacts 91% of advisers every day.

We provided the research for a report, in conjunction with Parmenion, which reveals how far short of expectations many adviser platforms are falling. The research found that over the last 12 months, 88% of advisers needed to apologise to at least one of their clients on behalf of a platform, and that poor service delivery from platforms impacts 91% of advisers every day.

Service means a lot of things to a lot of different people. It’s so subjective it can be hard to put your finger on. This paper aims to challenge the status quo and inertia that’s built up in the sector for many years.