When the first release is so good there is always a danger it will be difficult to maintain momentum and replicate the raw excitement second time around. The FCA’s Interim Asset Management Market Report, released last year, on a cold November Friday morning (with far less fanfare than today’s publication) was an incredible read – fresh, exciting and invigorating. Sadly, today’s second edition is more The Second Coming as opposed to (What’s the Story) Morning Glory. It’s ok, but ultimately it feels a wasted opportunity.

It’s far from terrible though. With a 7am release, followed by an 8am press conference with the FCA big cheeses it was never likely to be a cop out. The consultation from the first paper closed on Feb 20th, meaning the FCA had only around 3 months to review the responses before the final report was signed off so they clearly were not up for a discussion. Good job only 153 (out of 1840 UK authorised asset managers) bothered to take part…

Probably the most surprising announcement, and certainly the only new material, is of a consultation on whether there should be a sunset clause for trail commissions. Whilst the RDR banned commission for new investment business, the legacy is still very much there. The most recent FCA Data Bulletin shows that commission accounted for 26% of adviser firm net revenue in 2016, so if that is ‘switched off’ it’s going to hurt and the big question is what happens next.

Advisers can, at least in theory, replace the commission with fees, and the platform/provider (if the funds are not held direct) can start charging an explicit fee of their own. None of this is without a lot of complexity though, and as the platform sunset clause proved, it doesn’t necessarily mean the customer is better off as a result.

Technically, the platform sunset clause didn’t actually ban trail commission, but in reality that was the case. There were however some unintended consequences. In many cases the net total cost after unbundling was greater than the old bundled commission model. Mostly this was only by a few bps, but this is clearly not the direction of travel or the outcome the FCA seem to be expecting. Add in the potential tax impacts of altering/moving the affected assets and it’s a very complex area. The consultation will no doubt take time, but any adviser who is sitting on a large commission revenue stream might be best served to take action now, before it is forced upon them.

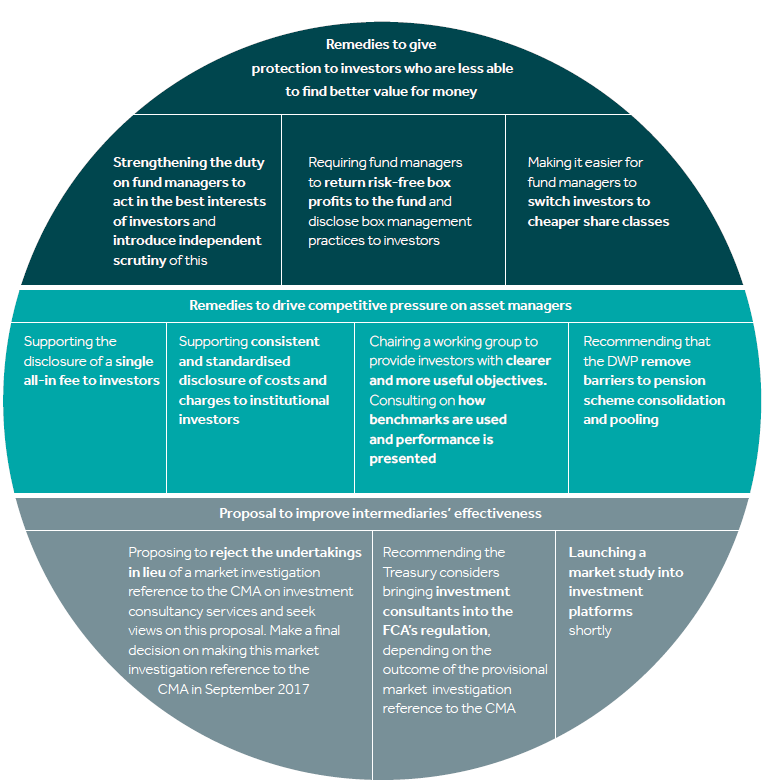

Elsewhere, the paper proposes 10 remedies to address the industry’s ills. Most of these require further consultation, some of which arrives today, with the rest to follow ‘before the end of 2017’. Great news if you are a fan of FCA consultations, but less so if you are a consumer invested in one of the many products they identify again as ‘significantly more expensive than average’.

And therein lies the rub. Whilst on one hand this reads like a hugely important paper, with a number of proposed remedies that should significantly improve customer outcomes, it’s all bark and no bite.

Absolute return investors ‘face a relatively high likelihood of negative performance’. The FCA, continue to be concerned that over ‘£109bn is invested’ in closet trackers. And there is still over £6bn in passives that are ‘significantly more expensive than average’. The worst offender in the list of expensive passives has grown from £2.7bn to £3.3bn AUA since the first paper was written, and you can still buy it at 1% today.

Alongside the product issues, the need for greater consumer protection is highlighted (again) in the annex documents. As with the interim report, 51% of consumers either don’t know, or don’t think they are paying charges for their investments. The current regime allows some providers to hide expensive product features in plain sight, and now they’ll be able to keep doing that for the foreseeable.

For the FCA to be identifying these issues, yet still not taking any action, is in this lang cat’s opinion, a dereliction of duty. These customers deserve better.

I, also think it is unreasonable, as suggested in the paper, to expect platforms to take on the role of driving down fund costs for the end investor. Negotiating discounts introduces cost and complexity into both platform and asset manager operations for the net result of just a few bps discount, often via a share class that is difficult/impossible to move elsewhere.

The industry, and more importantly the customers, might be better served by sweeping away all of this share class complexity, and charging one clearly disclosed price for all.

So, the verdict from lang cat HQ is a bit meh. It’s not quite at FAMR bullshit levels, but it’s not far off. Two papers into this story it’s time for some action. Let’s hope the coming months will bring exactly that. The industry is, in the main, saying the right things, but the FCA not only needs to lead the discussion, but to take steps to make change happen, and most importantly, protect consumers.