Groundhog Day (but with less rodents and more platforms)

Another day, another FCA paper, this time the snappily titled Investment Platforms Market Study Terms of Reference (MS17/1.1 to its mates). We’d heard talk of a deluge of regulation arriving once the FCA emerged from purdah and, since 21 June when the DB transfer consultation was published, we’ve now been treated to almost 500 pages […]

Groundhog Day (but with less rodents and more platforms)

Another day, another FCA paper, this time the snappily titled Investment Platforms Market Study Terms of Reference (MS17/1.1 to its mates). We’d heard talk of a deluge of regulation arriving once the FCA emerged from purdah and, since 21 June when the DB transfer consultation was published, we’ve now been treated to almost 500 pages […]

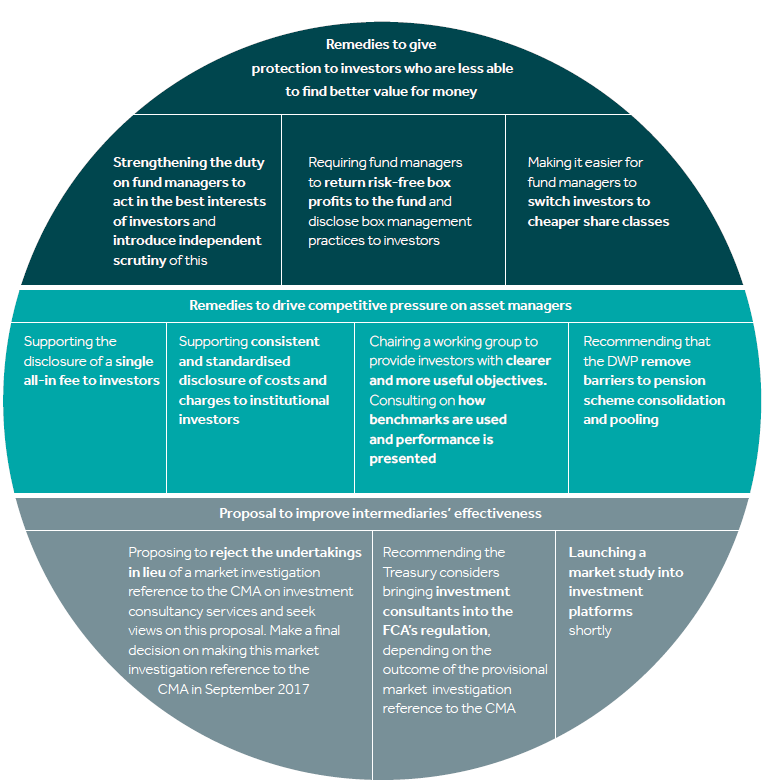

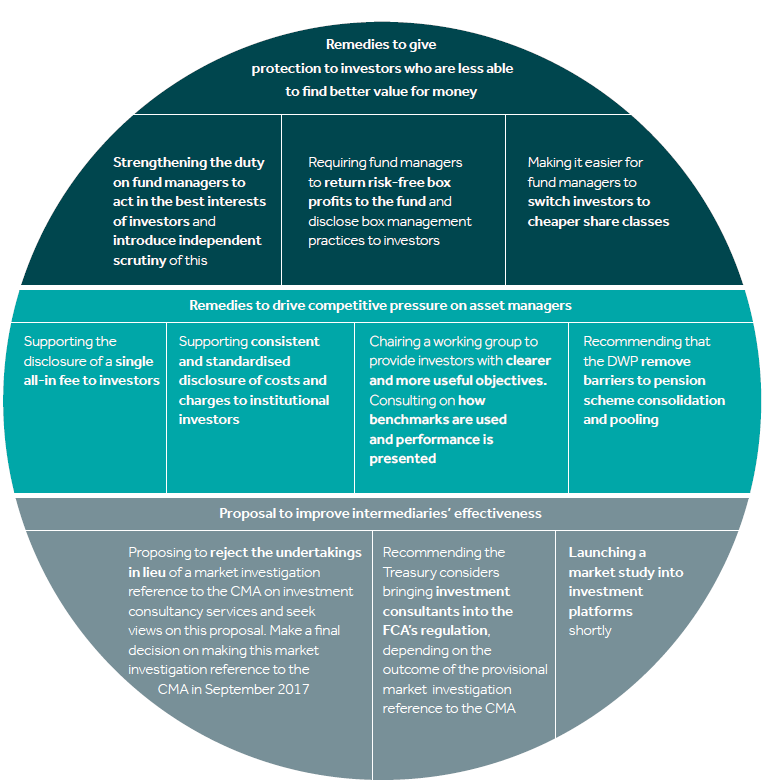

The FCA’s difficult second album

When the first release is so good there is always a danger it will be difficult to maintain momentum and replicate the raw excitement second time around. The FCA’s Interim Asset Management Market Report, released last year, on a cold November Friday morning (with far less fanfare than today’s publication) was an incredible read – […]

The FCA’s difficult second album

When the first release is so good there is always a danger it will be difficult to maintain momentum and replicate the raw excitement second time around. The FCA’s Interim Asset Management Market Report, released last year, on a cold November Friday morning (with far less fanfare than today’s publication) was an incredible read – […]

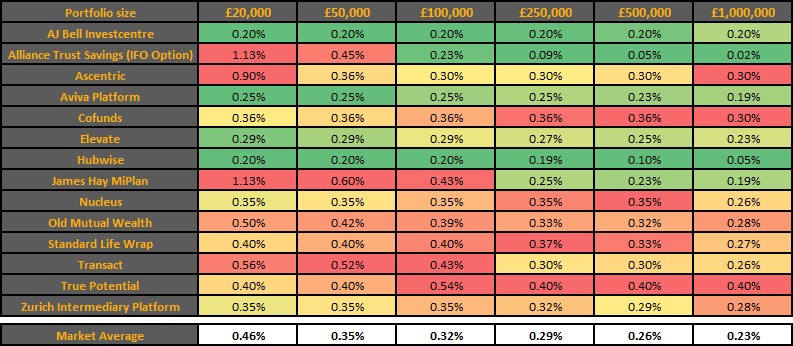

A WORD TO THE (HUB)WISE

It’s been ages since I’ve written a pricing blog. It’s also been a decent chunk of time since we’ve seen a new entrant to the advised platform market. A glorious piece of serendipity then to see that Hubwise has (re)launched[1] its advised proposition and given me reason to get the Casio out. Those who monitor […]

A WORD TO THE (HUB)WISE

It’s been ages since I’ve written a pricing blog. It’s also been a decent chunk of time since we’ve seen a new entrant to the advised platform market. A glorious piece of serendipity then to see that Hubwise has (re)launched[1] its advised proposition and given me reason to get the Casio out. Those who monitor […]

IS IT ME OR IS IT GETTING HOT IN HERE? SCALABLE CAPITAL & INVESTEC’S BIG DAY

Well, after a period in which all the talk was of funding moving away from robo-advice to ‘insurtech’ and ‘regtech’ and other things ending in ‘tech’ that neither you nor I understand, BlackRock and Scalable Capital have come from nowhere and given us all plenty to talk about. (Before I crack in, a bit of […]

THE DAY PENSIONS GOT EDGY

Yesterday, over 200 pension-world glitterati gathered at Peterborough Showground in front of a sterling cast to debate the big issue in pensions today: DB to DC transfers. It was absolutely roasting. There was energy in the room. There were arguments. People were wearing shorts. I wished I was wearing shorts. Before I go any further, […]

IS IT ME OR IS IT GETTING HOT IN HERE? SCALABLE CAPITAL & INVESTEC’S BIG DAY

Well, after a period in which all the talk was of funding moving away from robo-advice to ‘insurtech’ and ‘regtech’ and other things ending in ‘tech’ that neither you nor I understand, BlackRock and Scalable Capital have come from nowhere and given us all plenty to talk about. (Before I crack in, a bit of […]

THE DAY PENSIONS GOT EDGY

Yesterday, over 200 pension-world glitterati gathered at Peterborough Showground in front of a sterling cast to debate the big issue in pensions today: DB to DC transfers. It was absolutely roasting. There was energy in the room. There were arguments. People were wearing shorts. I wished I was wearing shorts. Before I go any further, […]