Aviva and FNZ up a tree, R-E-PLAT-FORM-I-N-G

Just a quick few thoughts on the news from Aviva today that it plans to migrate its platform from Bravura to FNZ. For those not intimately involved, Bravura and FNZ, along with GBST (disclosure: GBST is a client of ours) are the three big beasts of outsourced platform technology in the advised space. IFDS is […]

Booting ISAs in the baws – tax year end 2015/16

Well now, the IA has just put out its stats for tax year end (TYE) 2015/16 and it’s not nice reading. The full release is here but this table which I nabbed from the release tells quite a story. 2014/15 was generally reckoned to be a relatively sucky year for the ISA season, which has […]

REMIND ME WHY WE’RE DOING THIS AGAIN?

There’s a theme running through the FCA’s Consultation Paper 16/12: Secondary Annuity Market proposed rules and guidance. If you’ve braved all 112 pages (or any of them really) you might have spotted it. Here are some clues! Paragraph 1.7, We believe that there is a significant risk of poor outcomes for consumers in the secondary […]

UFPLS NO MORE?

There’s a new endangered species to add to the ever growing list. Never mind your black rhinos or your Sumatran orangutans. No, the one we need to worry about is UFPLS. The ABI has called time on pensions jargon. It’s consulting on a new guide to pensions language which will clear away the confusing in […]

All change in platform land

After a quiet few months in platform land it feels like things are about to change, and potentially quite dramatically. There are a number of rumours doing the rounds, here, here and here, and these are just the ones that have been published. At lang cat HQ we do have a view as to how […]

EVERYTHING COMES TO THOSE WHO WAIT (KIND OF)

He likes to work a crowd does our Gideon. To be fair, it’s his big moment of the year. The key note speech. The one time people will generally sit and listen to him with only a modicum of heckling. But even at that he was outclassed and upstaged. Between Theresa May’s cleavage and the […]

E-I-E-I-Oh, not that kind of FAMR then

We’ve already taken a light touch (ahem) look at the FAMR report overall but, in among all the consultations and not consultations and the stuff that is actually going to happen but will take time and the fact that aspects might get upended by MiFID II at some point over the next 18 months, lies […]

FAMR: we call bullshit

FAMR could have been huge. It could have been beautiful. It could have been the equivalent of three lines of really good crank washed down with a triple espresso for the good end of the advice profession. It could have done so much. But it didn’t. Instead, what we got was 80-something pages of prevarication, […]

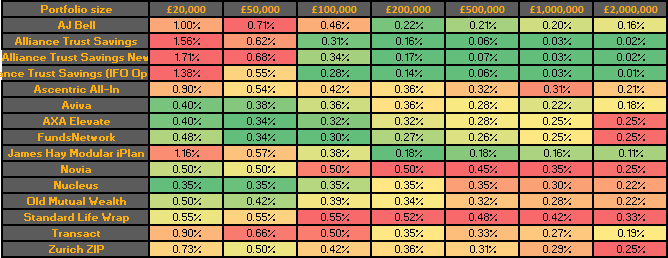

Bow before the power of arithmetic: ATS ups charges

So we haven’t had any large price changes for a while, hence no pricing blogs. A debt of thanks, then, to Alliance Trust Savings (ATS) who upped its fixed fee charges last week along with unveiling its results (find Citywire coverage of those here) and rolling out its new GBST-powered system to users. Now, before […]

Please welcome @langcatlucy

Afternoon, just a short post. I’m delighted and intimidated in equal measures to say that today we welcome a new addition to the ranks at the lang cat. Please say a heartfelt hello to Lucy Edmans. Hello Lucy! Delighted, because Lucy has joined to help us fulfil some of the many big plans we have […]