Thank God that’s over – the lang cat roundup of 2016

If you’re reading this, well done. You have only – assuming you’re in the UK – to survive 8 more hours and you’ve got through a year that’s been remarkable for all the wrong reasons. If you’re one of our Australasian readers, stop being smug. We know you’re across the line already. I do one […]

Thank God that’s over – the lang cat roundup of 2016

If you’re reading this, well done. You have only – assuming you’re in the UK – to survive 8 more hours and you’ve got through a year that’s been remarkable for all the wrong reasons. If you’re one of our Australasian readers, stop being smug. We know you’re across the line already. I do one […]

the lang cat’s albums of 2016

Last year when I wrote this, Mike Barrett got in touch to say ‘not in my name’ and it was generally agreed that I don’t speak for the whole lang cat team when I do these lists. So before I get going, in the interests of balance: Mike, our own superstar DJ, has his own […]

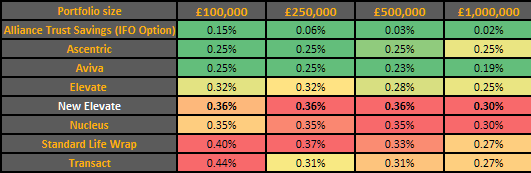

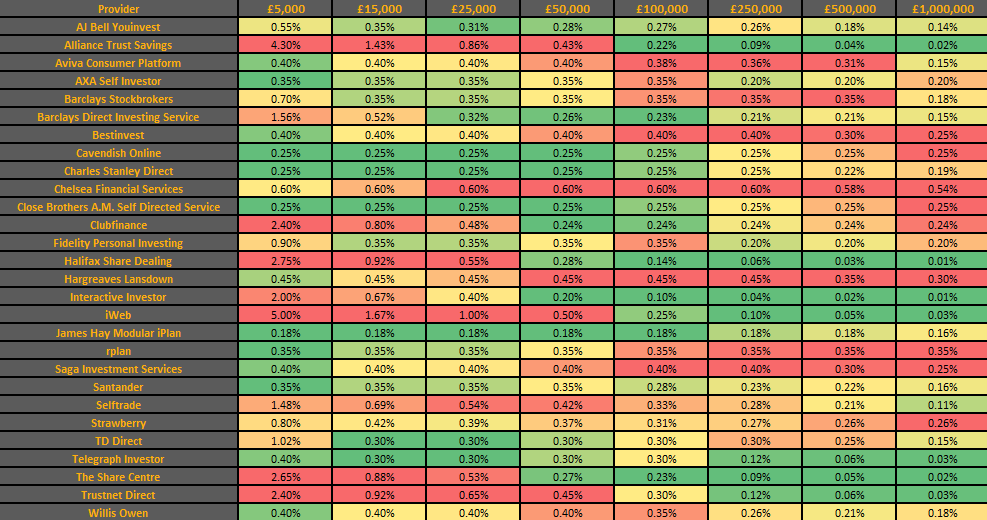

No escaping basic arithmetic – all about the ATS price changes

As 2016 breathes its last, we are plagued, sorry, blessed by a mini-flurry (Worst. Flurry. Ever.) of pricing changes from platforms. Last week we had Elevate / SL; this week it’s our Dundonian friends, Alliance Trust Savings. ATS is increasing its fixed fees on both direct and advised business, but offsetting that in part with […]

No escaping basic arithmetic – all about the ATS price changes

As 2016 breathes its last, we are plagued, sorry, blessed by a mini-flurry (Worst. Flurry. Ever.) of pricing changes from platforms. Last week we had Elevate / SL; this week it’s our Dundonian friends, Alliance Trust Savings. ATS is increasing its fixed fees on both direct and advised business, but offsetting that in part with […]

What’s 0.04% amongst friends? Standard Life hikes Elevate prices; causes eyebrow raising in Leith.

I’ve always liked folk who buck trends. Counter culture is my favourite kind of culture. So you’d think I’d be supportive of Standard Life’s decision to buck the downward trend of platform pricing by increasing Elevate’s charges. And in some ways I am. In others, though, I’m not, and I’ll tell you for why. It’s […]

What’s 0.04% amongst friends? Standard Life hikes Elevate prices; causes eyebrow raising in Leith.

I’ve always liked folk who buck trends. Counter culture is my favourite kind of culture. So you’d think I’d be supportive of Standard Life’s decision to buck the downward trend of platform pricing by increasing Elevate’s charges. And in some ways I am. In others, though, I’m not, and I’ll tell you for why. It’s […]

Guess who’s back, back again

The last few months have been an exciting time for Leith’s leading * platform and investment consultancy. We’ve never been busier, and increasingly we are convinced that most of our core markets are about to be disrupted. The recent FCA Asset Management Study is without doubt my favourite read of the year, a real page […]

Guess who’s back, back again

The last few months have been an exciting time for Leith’s leading * platform and investment consultancy. We’ve never been busier, and increasingly we are convinced that most of our core markets are about to be disrupted. The recent FCA Asset Management Study is without doubt my favourite read of the year, a real page […]

Where are the customers’ yachts?

So, exactly a year after the terms of reference were published, the FCA has lifted the lid on the asset management industry’s Pandora’s box in what could well (and hopefully will) prove to be a landmark market study. If ever you had any doubts of the depth & range of issues, 689 pages of documents, […]