5 not out

So a big week for me and for the lang cat, although there’s no time to stop and reflect. Yes, this is one of those self-indulgent milestone blogs. Feel free to stop reading. It’s five years ago this week that I left corporate life and started out on what would become the lang cat. With […]

The exciting ever changing world of platforms

The exciting ever changing world of platforms. The current state of the UK platform market is as exciting as it’s been for a long while, and in our view there are some hugely significant changes taking place. Over recent weeks we have seen a number of platforms being rumoured as being up for sale, and […]

What should we do about sequence risk?

Sequence risk has been a hot topic lately and with recent market volatility questions of post-retirement portfolio construction are at the forefront of advisers’ minds. However, new research from CWC Research produced for the FE Investment Summit later this month, finds adviser attitudes towards sequence risk and its management within retirement portfolios vary widely across […]

What will September bring?

If there is one thing I’ve learnt during 20 years in financial services, it’s that August is traditionally a quiet month. Everyone goes on holiday and then frantically crams in two months work into September. Already I can feel the September surge coming through, but this time it feels different. Quite a lot did happen […]

LETTER FROM AMERICA: ALL THE MONEY IN THE WORLD

Big news today that BlackRock, which looks after more money than you can POSSIBLY IMAGINE, has bought the robo-adviser (and I might be sitting in New York but I’m still going to spell, adviser! correctly) FutureAdvisor for an undisclosed sum which the FT reckons is between $150m and $200m. OK, so a takeover, no biggie. […]

LETTER FROM AMERICA: MARKETS DOWN? TIME TO SUIT UP

As Bill Hicks once said, oops, did I leave a cigarette lit or something? As I write! Dow down 6.5%, over 1,000 points. FTSE 100 down 3.5% China down a shitload European indices down over 5% Twitter meme incidences of traders with head in hands up by 5 million percent. So the correlation of two […]

It’s all in the game

One of the most iconic scenes in The Wire is the court room scene where Omar, a character who has a penchant for murdering drug dealers, is being cross examined by an especially slimy prosecution lawyer. After a couple of minutes of the lawyer lambasting our hero for living off the drug trade and creating […]

Price: only important in the absence of clear value

Last week the lang cat launched PLATFORM PRICING PROPHECIES: PAST PRESENT AND PHUTURE. If you haven’t downloaded it yet, consider yourself on the naughty step? but don’t worry? you still can and all will be forgiven. Calling it as we see it is kind of our thing and the paper has elicited (ooh fancy) a […]

Better communications: Only smarties have the answer

I was interested to read the FCA’s discussion paper around smarter consumer communications, published yesterday here. The Regulator has recognised the fact that the way the financial services industry communicates with its customers often leaves a lot to be desired. Christopher Woolard, director of strategy and competition, said: “information itself does not necessarily empower the […]

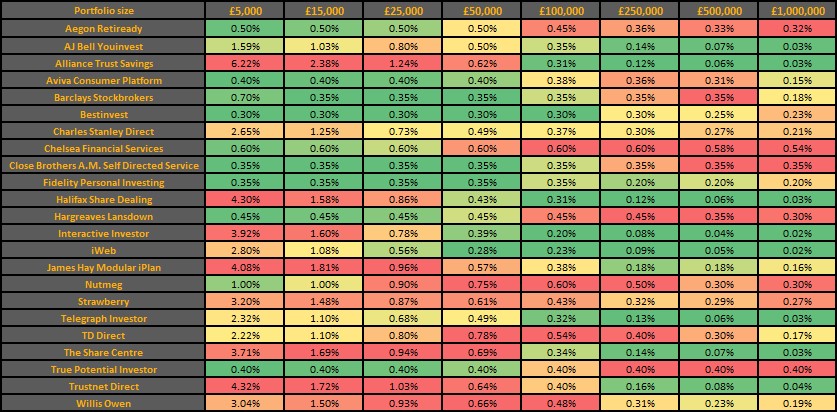

On-brand heatmapping: Aviva goes D2C

On Friday past, the gaffer shared his thoughts on the difficulties facing new entrants to the already stacked D2C market. In it, he alluded to details of a new entrant emerging any day now. Well, today Aviva has launched its platform for consumers, cryptically named the Aviva Consumer Platform. The platform is powered by FNZ […]