Life is harder now (in investment outsourcing, anyway)

Earlier this week the lang cat and CWC Research launched Never Mind the Quality, Feel the Width, a new, in-depth study of the outsourced centralised investment proposition (CIP) marketplace. The report is made up of qualitative adviser and industry interviews by CWC Research, alongside quantitative analysis by the lang cat of a range of discretionary […]

Nothing to do with buses

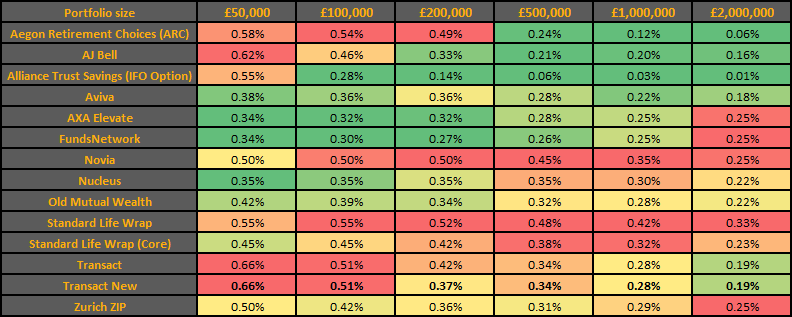

Hello again. You know what they say; platform pricing changes are like buses. You wait ages for one to come along and then! Actually, no-one says that. It’s a rubbish analogy. And the buses around here are pretty good. Anyway. Yes, only a week ago we were digesting the pricing changes made by Ascentric, and […]

Nothing to do with buses

Hello again. You know what they say; platform pricing changes are like buses. You wait ages for one to come along and then! Actually, no-one says that. It’s a rubbish analogy. And the buses around here are pretty good. Anyway. Yes, only a week ago we were digesting the pricing changes made by Ascentric, and […]

Cards on the table: Ascentric goes all-in

It’s been ages since I’ve blogged, mainly as it’s been a while since a provider made a big pricing shift. Most of the activity on that front in recent times has understandably focused on changes to SIPP and drawdown fees following the budget. Quite a number have trimmed charges, with some removing them altogether. Which […]

Cards on the table: Ascentric goes all-in

It’s been ages since I’ve blogged, mainly as it’s been a while since a provider made a big pricing shift. Most of the activity on that front in recent times has understandably focused on changes to SIPP and drawdown fees following the budget. Quite a number have trimmed charges, with some removing them altogether. Which […]

The freedom to get screwed

We measure out our lives by different things. J Alfred Prufrock measured his out by coffee spoons. For many of us our lives are marked out by Christmases, Hogmanays, birthdays and anniversaries. But in financial services, our lives are marked out by two things: politicians dicking around with pensions, and mis-selling scandals. This being an […]

The freedom to get screwed

We measure out our lives by different things. J Alfred Prufrock measured his out by coffee spoons. For many of us our lives are marked out by Christmases, Hogmanays, birthdays and anniversaries. But in financial services, our lives are marked out by two things: politicians dicking around with pensions, and mis-selling scandals. This being an […]

The lang cat’s albums of 2014

Another year passes, another trip around the sun, another year closer to our eternal reward, another blog about music that no-one will read. Time, as you know, is an artificial construct designed to explain the otherwise random passing of events, and an attempt to place order on a pointless and terrifying universe. 365 days is […]

The lang cat’s albums of 2014

Another year passes, another trip around the sun, another year closer to our eternal reward, another blog about music that no-one will read. Time, as you know, is an artificial construct designed to explain the otherwise random passing of events, and an attempt to place order on a pointless and terrifying universe. 365 days is […]

MAKING A DRAMA OUT OF A CRISIS

Those ‘OMG’ I’m going to get fired! moments in the life of a PR are actually quite rare. Thankfully. But they are moments that stay with you for ever. My biggest OMG moment came on 17 January 2008 when a relative non-story (I would say that, wouldn’t I?) around the temporary closure of a property […]