RETIREMENT INCOME IN THE DIRECT PLATFORM MARKET

When the pension freedoms landed in 2015, we figured the market would take a year or so to settle and then the interesting stuff would start to emerge – proper innovation to let consumers get their hands dirty and take control of their retirement investments and income.

Nearly four years on and we’re still waiting. The FCA’s investment pathways consultation is a step in the right direction, but we’re holding out hope for some bona fide innovation.

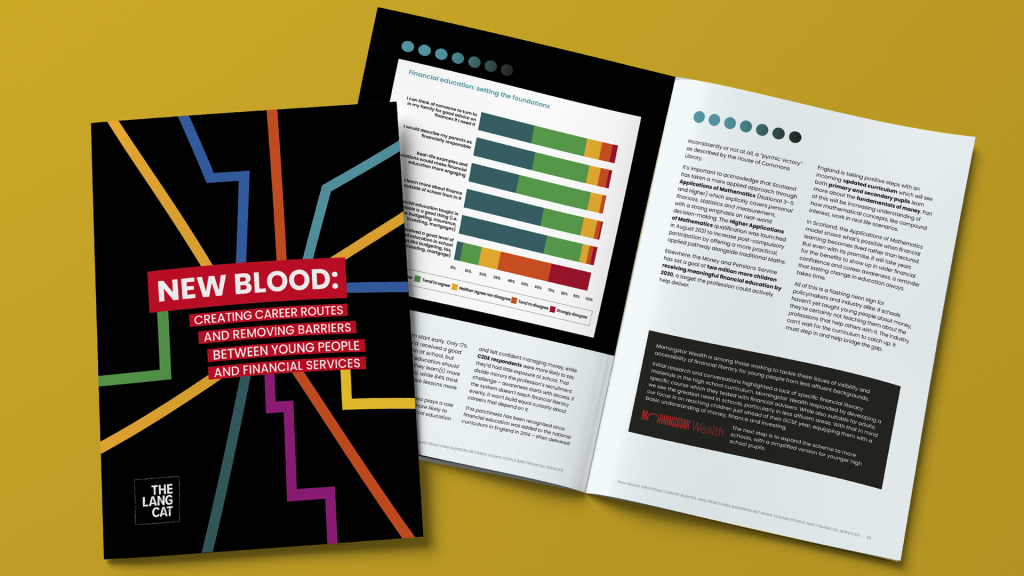

In this paper, we look at the retirement income solutions currently on offer to direct investors and how effectively those investors are being supported in making decisions and taking income.

While there is a lot of good functionality out there, true innovation remains lacking, with gaps such as helping investors understand how much they might need to live on each month and how to use assets other than their pensions to fund it.

We don’t spend the whole time complaining, however. We also share our ideas about how things can change for the better.

DOWNLOAD! BE FREE!

There’s no charge for downloading this paper. It may not be innovative but it’s a popular approach.

We’re big fans of full disclosure: GBST paid us to write this paper. It clearly has a commercial interest in the market and you’ll notice that some of the providers we look at are GBST clients. You’ll also notice that some are not. None of that makes any difference to our analysis or our commentary. Everything is as it would be if we weren’t being paid.