PLATFORMS THROUGH THE LOOKING GLASS

If it was a human, the platform sector would be studying for its A levels (or Highers, if it lived in Scotland). It would have started drinking about two years ago, wouldn’t be able to get a Glastonbury ticket for love nor money and would be seriously confused at the concept of a telephone that’s […]

PLATFORMS THROUGH THE LOOKING GLASS

If it was a human, the platform sector would be studying for its A levels (or Highers, if it lived in Scotland). It would have started drinking about two years ago, wouldn’t be able to get a Glastonbury ticket for love nor money and would be seriously confused at the concept of a telephone that’s […]

Thank God that’s over – the lang cat roundup of 2016

If you’re reading this, well done. You have only – assuming you’re in the UK – to survive 8 more hours and you’ve got through a year that’s been remarkable for all the wrong reasons. If you’re one of our Australasian readers, stop being smug. We know you’re across the line already. I do one […]

Thank God that’s over – the lang cat roundup of 2016

If you’re reading this, well done. You have only – assuming you’re in the UK – to survive 8 more hours and you’ve got through a year that’s been remarkable for all the wrong reasons. If you’re one of our Australasian readers, stop being smug. We know you’re across the line already. I do one […]

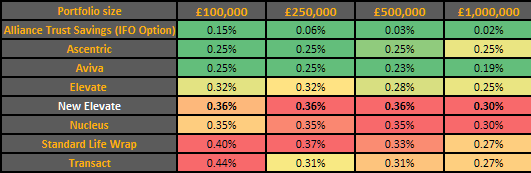

No escaping basic arithmetic – all about the ATS price changes

As 2016 breathes its last, we are plagued, sorry, blessed by a mini-flurry (Worst. Flurry. Ever.) of pricing changes from platforms. Last week we had Elevate / SL; this week it’s our Dundonian friends, Alliance Trust Savings. ATS is increasing its fixed fees on both direct and advised business, but offsetting that in part with […]

No escaping basic arithmetic – all about the ATS price changes

As 2016 breathes its last, we are plagued, sorry, blessed by a mini-flurry (Worst. Flurry. Ever.) of pricing changes from platforms. Last week we had Elevate / SL; this week it’s our Dundonian friends, Alliance Trust Savings. ATS is increasing its fixed fees on both direct and advised business, but offsetting that in part with […]

What’s 0.04% amongst friends? Standard Life hikes Elevate prices; causes eyebrow raising in Leith.

I’ve always liked folk who buck trends. Counter culture is my favourite kind of culture. So you’d think I’d be supportive of Standard Life’s decision to buck the downward trend of platform pricing by increasing Elevate’s charges. And in some ways I am. In others, though, I’m not, and I’ll tell you for why. It’s […]

What’s 0.04% amongst friends? Standard Life hikes Elevate prices; causes eyebrow raising in Leith.

I’ve always liked folk who buck trends. Counter culture is my favourite kind of culture. So you’d think I’d be supportive of Standard Life’s decision to buck the downward trend of platform pricing by increasing Elevate’s charges. And in some ways I am. In others, though, I’m not, and I’ll tell you for why. It’s […]

D2C’s big CPA day out: Nutmeg’s results and Vanguard’s plans

HEALTH WARNING: We’ve had some fun guessing at Nutmeg’s figures in this blog. Our guesses are just that, and we don’t make any claim for their accuracy. We’d love to have accurate figures, but until we do please treat any figures in red as (hopefully) interesting, but no more than that. If you’re interested in […]

D2C’s big CPA day out: Nutmeg’s results and Vanguard’s plans

HEALTH WARNING: We’ve had some fun guessing at Nutmeg’s figures in this blog. Our guesses are just that, and we don’t make any claim for their accuracy. We’d love to have accurate figures, but until we do please treat any figures in red as (hopefully) interesting, but no more than that. If you’re interested in […]