What up took woo fam. It’s Rich Mayor here, stepping in for an ailing Polson, who’s currently struck down with flu – the sort attributed to the male section of civilisation. So you’ve got me instead.

And what have I been up to? Well, I climbed a big hill in the Lake District. Striding Edge on Helvellyn, no less. At moments it was a reminder of my mortality if nothing else. Fun times were had by all, and I’m fairly sure we finished with the same number of trekkers as we started with.

Fun times ahead too. At least two lang cats are gearing up for the first South Coast (league) derby between Portsmouth and Southampton in 13 years. Thirteen years of waiting, and it’s finally next week. Safe to say the city in blue is gripped. It’s even the topic of conversation at a neighbouring table as I write this from a beachside coffee shop, in between flicking v’s at resident Lang Cat Southampton supporter Mike Barrett over on the Isle of Wight.

Since the last derby, I’ve been studying the platform market. And with that immaculate, not-at-all clunky segue, let’s talk about what we’re seeing in the advised platform market in Q2, now the final numbers are in.

Headlines, then. You might’ve seen that new business flows onto platforms are once again very strong, if down a smidge from Q1. What’s even more encouraging is what advisers told us about Q2 business.

Firstly, when it comes to the split between transfers of existing business and brand new money coming onto platforms, there’s been a slight tilt towards new business in 2025. At the halfway point in 2024, it was mostly transfers. Why the change? A few things come up consistently: demand for advice has never been higher, thanks to CGT allowance cuts, IHT on pensions, and plenty of rumours about what might happen to pensions next.

Secondly, most advisers told us the busy first half has rolled into Q3. That could set us up for a record-breaking year for platform new business in 2025. Of the five best quarters ever in the advised market, three have been in the past three quarters. The other two were during the record year of 2021 and the DB transfer peak some years before that.

Headlines then (part two). Outflows across the market are down for a second consecutive quarter, and by a meaningful margin. What’s going on? One of the main reasons advisers gave for higher withdrawals was clients coming off favourable mortgage deals while interest rates spiked. Add competition from cash and cash-like products, and you had a recipe for higher outflows. But those pressures should ease as rates continue to at least tentatively step down.

Withdrawals linked to client behaviour aren’t really controllable for platforms. In fact, the ability to access wrappers like this is proof that platforms are working as they should. What is controllable, though, is money flowing to competitors. Traditionally that meant other advised platforms, where the response was to plug gaps in service, tech or price. Most of those gaps have now been dealt with, and where they still exist, platforms are working harder than ever to close them. Nothing like record outflows to spur action.

What’s interesting now is platforms stepping off-platform, so to speak. We’re seeing more of what used to be “off-platform” becoming part of the offer: smoothed managed funds, bond wrappers, and products that at least resemble annuities.

Data from the Association of British Insurers shows annuities are still strong and outflows trend lines track them closely. Volumes are roughly double what they were during the DB transfer boom, and average values are close to double too.

We’ve seen Fidelity’s tie-up with Standard Life on the Guaranteed Lifetime Income plan earlier this year, that holds guaranteed income within a flexi-access drawdown account on platform. And more recently there are rumours that Aviva is working with GBST on an annuities portal.

Launching a new portal with a different tech provider might raise eyebrows, but there’s precedent. Scottish Widows, for instance, reportedly replatforming its Halifax Sharedealing D2C book to GBST, even though FNZ provides its core tech.

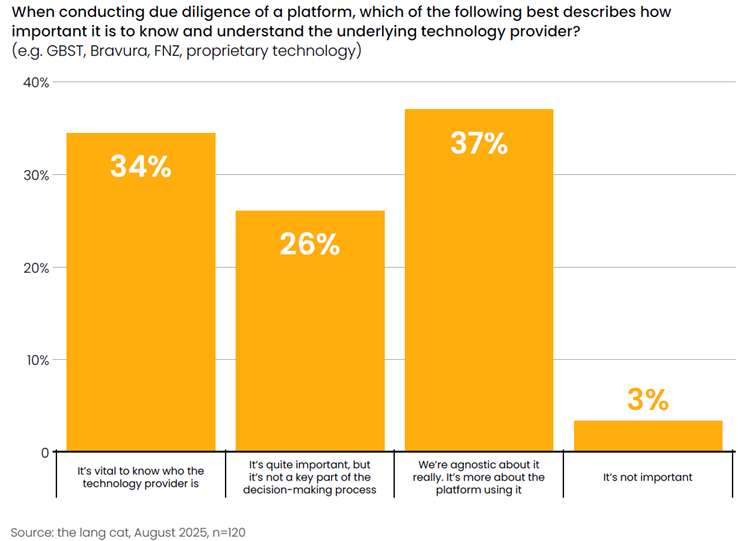

So how important is the tech provider to users? Maybe not as critical as we once thought. It matters to know who it is, of course, but what matters more is the platform itself. And that means data needs to flow cleanly between all concerned.

Which brings us to the final part of the advised platform sales equation: net sales. Unsurprisingly, they’ve risen this quarter. They’re the best for a few years, though still some way short of the highs we saw during the hay-making years. With outflows likely to stabilise at a higher level than before, platforms will need to work harder to attract new business. Adding off-platform propositions into your on-platform mix should help manage controllable outflows, while also giving you a shiny new thing your friends don’t yet have.

That’s all from me this week.

All the best – up the blues.

Rich