While we at the lang cat were busy compiling our research for The Advice Gap 25, the FCA’s own work to address the advice gap was also underway.

With perfect timing (and we would like to think, following our lead) the regulator published its latest plans a mere matter of days after we launched our report.

The proposals are still under consultation, but it’s a short consultation, taking place over the summer when most people are off on holiday. That’s the regulator’s way of saying: “We have to consult, but we’re doing the bare minimum because we reckon this is it.”

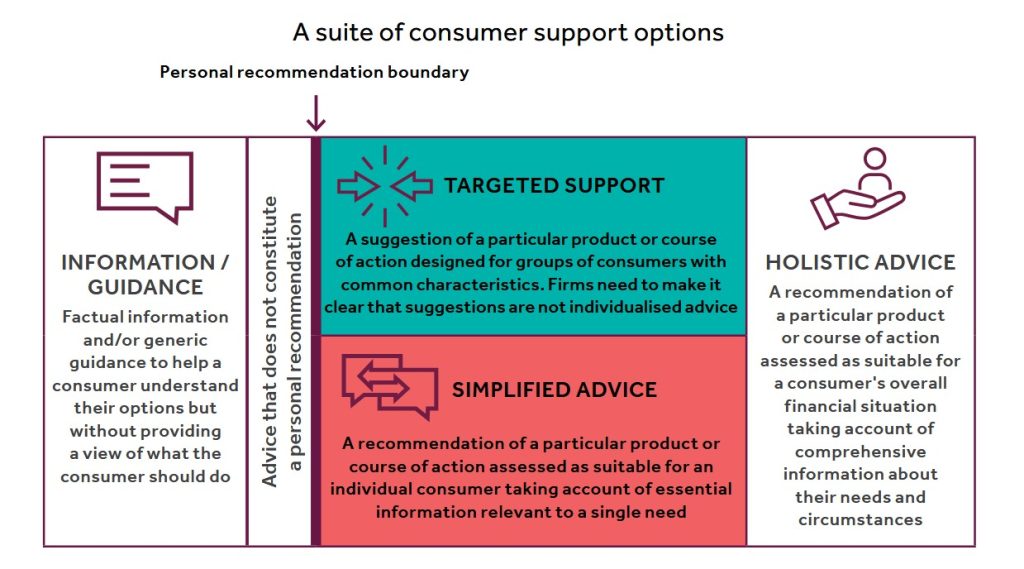

The most important point is that the new offering, targeted support, will sit alongside other services.

These are unregulated guidance, simplified advice (which already exists but hasn’t been enthusiastically taken up by firms wary of the advice guidance boundary), and full ‘holistic’ advice in what the FCA is calling “a continuum of support”.

The support options on the table

At one end of the scale, guidance can still be provided outside the world of regulation to help people understand their options.

Targeted support is a suggestion of a particular product or course of action designed for groups of consumers with characteristics in common.

Simplified advice is a recommendation of a particular product or course of action assessed as suitable for an individual consumer, taking account of essential information relevant to a single need.

And at the other end of the scale holistic advice, which remains the gold standard, is a recommendation assessed as suitable for a consumer’s overall financial situation, taking into account comprehensive information about their needs and circumstances.

We can expect the final part of the jigsaw later this year when the FCA consults on amendments to its rulebook (that’s COBS 9/9A for the compliance enthusiasts among you) to create a clearer distinction between simplified and more holistic advice.

What about Consumer Duty?

Firms offering targeted support will still be subject to Consumer Duty. Potentially the most important element of that is communication.

There will be an obligation to communicate clearly with customers. Firms providing this service must be transparent about its nature, limitations, and the basis of any recommendations, making sure consumers understand they’re not receiving tailored advice.

And the cost will need to be communicated – although the answer in most if not all cases will be nothing. The FCA expects, and has based this on feedback from firms thinking of entering the market, that the service will be provided without charge.

Consumers will have access to the Financial Ombudsman Service (FOS) if anything goes wrong, and the key to any FOS decision will be whether consumers understood what they were being offered and why.

We asked in our Advice Gap research whether people thought targeted support would be helpful. You can look at the data a few different ways, and it was seen as potentially helpful by 41% of respondents when offered by a pension provider, 39% when provided by a bank, and 35% when delivered by an investment firm. The percentages fall though when we asked whether people would act on the suggestions.

Yet overall that’s a big chunk of people who are at least open to the concept of targeted support. It’s not designed to replace full advice, but it could be the stepping stone that clients use to take them towards full advice as their needs evolve.

There is an important takeaway for advice and planning firms in all this. No doubt you already explain the value you can bring to new and existing clients. What will change under this framework is you’ll need to explain the added value of your services in the context of this new ‘continuum of support’ world.

Alison Gay is senior regulatory consultant at the lang cat

For more on The Advice Gap 2025 report, visit our dedicated website for the latest analysis, stats, case studies and more