Good afternoon, Mike here. Right about now (assuming you are reading this on Wednesday lunchtime/afternoon) we will be smack in the middle of our second #langcatlive for 2022, the HomeGame in Edinburgh. If you’ve missed out you can catch up via the socials and we’ll also post the highlights on YouTube in the days to come. Also, please save the date for our 2023 London event.

A few years ago I found myself in a cab from Harrogate station, travelling to one of the many fine conference venues up that way. The taxi driver asked me what I do for a living (which to be fair, is a very good question) and I mumbled something about working in pensions and investments. In response he turned the radio on and didn’t say another word for the rest of the journey.

In normal times this is par for the course – like my driver, most people would rather listen to TalkSport than chat to me about pensions. Last week, however, was far from normal. I had numerous calls/messages from friends and family who were worried and wanted to know what was going on. And based on a quick chat amongst my fellow cats, I wasn’t alone.

Some of this has been bubbling away for a while now. One friend in particular has been regularly sense-checking what she should do re mortgages/interest rates, utility bills, savings etc. My guess is that she is not alone – the majority of folk will have been looking at what is and isn’t affordable over recent weeks. Personal finance is suddenly a hot topic.

But this time was different. People had seen and heard talk of “mass insolvencies of pension funds” and were worried. My friends and family wanted to know how much they were going to lose, should they move their pensions, and generally WTF was actually going on. Never mind TalkSport, we want to TalkPensions*.

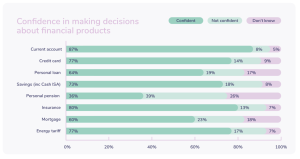

A few years ago as part of the Advice Gap research we conducted for Open Money, we asked consumers (via YouGov) about their confidence in managing various financial products. Only 36% of consumers said they are confident in managing their personal pension. This figure more than doubled for savings, current accounts and energy tariffs. It is rare that pensions feature in the news, but when they do, most people don’t understand what is going on. Alarmist headlines will only make this worse.

Over the weekend the more considered (and informed) personal finance press set out to reassure their readership, but my fear is the damage had already been done. Whenever pensions and investments hit the headlines it is rarely good news: No one ever writes the “Billions wiped back onto stock markets” headline when the markets recover. This lack of understanding isn’t a problem we can expect the media to solve, it is up to the pensions industry as a whole to address. Last week the FCA was reminding firms that, under Consumer Duty consumers must receive “timely and clear information that customers can understand so they can make informed financial decisions”, so it appears the regulator agrees.

*Worst radio station ever.

ENJOY THESE LINKS

- FAO anyone who works in an advice firm. We’d love it if you could complete our annual State of the Adviser Nation survey. Lots of good things will happen if you do. Maybe.

- FAO Netflix commissioning editors. Kim Kardashian+Crypto+massive fine from regulator = instant click from me if you make this into a documentary.

- FAO anyone interested in Consumer Duty and service standards. New-ish lang cat Alison is talking a lot of sense here.

- FAO advisers in the Glasgow, Birmingham or London areas. Those nice folk at EV are out on the road later this month, talking about the challenges of managing client portfolios in these uncertain times. Sign up here

ONE MORE TUNE

Enjoy some early 90s house music sampling The Beastie Boys & The Pixies – absolute banger as the kids would say.

See you next time

Mike