Hello there!

This week, a solar eclipse covered the skies of much of America, peppering social media with glorious photographic reminders of our insignificance in the vastness of space. In Portsmouth (in old England, not new), I spent the day peering longingly out the window, pining for a glimpse of our giant star again, as rain trickled down the pane for the 4,878th consecutive day.

Coincidentally (and terrifyingly), I’m due to embark on my fortieth orbit around that big star tomorrow, and to stave off the associative existential dread I’ve been doing what I do a lot at the lang cat… writing about platform stuff.

We’ve just put the finishing touches to our 12th edition of State of the Platform Nation. SOTPN, pronounced by ‘soht-puhn’ internally (which I think we can all agree is a new low for an industry besotted with acronyms… and it’s not even an acronym) covers loads of stuff about platforms: their flows, strategies, pricing, what advisers think about them, what they want from them, and frankly far too much to cram into a weekly email Update (especially when you’re spending as much time as I have talking about the sun), so I’m gonna focus on that last one – what advisers want from platforms, or rather… what’s changed?

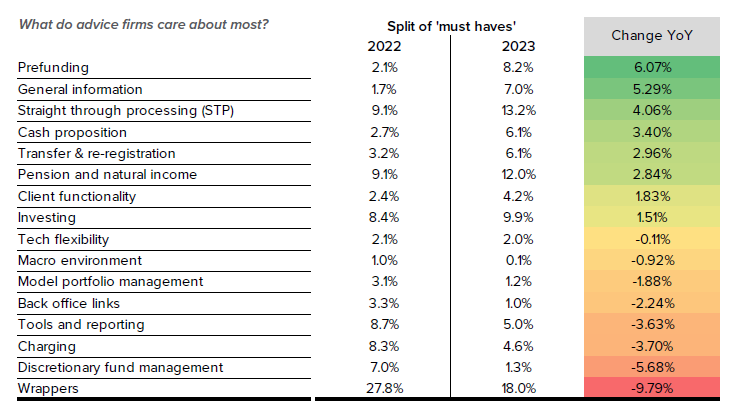

Platform due diligence is still done about once a year on the whole, and in Analyser advisers and paraplanners can pick essential ‘must-haves’ for a platform to proceed through to platform selection. Here’s how the trends have changed from 2022 to 2023.

Starting off just at a headline level, we’ve sorted the split of must-have features by their categories in terms of what’s seen the biggest movement from 2022 to 2023. While wrapper availability forms the biggest chunk of all must-have selections, this is – in the main – much more of a hygiene factor these days. You’ll be very hard-pressed to find a platform that doesn’t have an ISA, GIA and SIPP and that’s reflected in wrappers dropping in the share of overall must-haves in 2023.

The category gaining the most traction was a surprise to us: prefunding. Prefunding of pension tax relief and regular contributions are the most popular must-haves regarding paying money in, but it’s also important for moving money around. Prefunding bed and ISA/pensions as well as for switches is highly ranked in this category. Towards the bottom of the prefunding must-haves is prefunding withdrawals and also being able to instruct trading while another is in flight (stacking instructions rather than ‘please try again in T+5’).

Underpinning the themes of prefunding is an increased appetite for efficiency in the execution of financial plans and far less faffing about. This is consistent with another finding during our work on service last year with abrdn which found – in no uncertain terms – that paper is to be avoided like the proverbial plague if you want to work with advisers. This informs most of the results within the straight through processing category, and centre around placing new business without having to send paper.

Onboarding products via contributions and transfers, and topping up those products as a straight through process, form over 70% of the must-haves here, and that’s supported by the increase in must-haves for other aspects of the transfer and re-registration category. The bulk of the remaining choices focus on getting money out efficiently.

We come to cash propositions next, and while it’s unsurprising that this is further up the table for must-haves in 2023, 73% of these must-have features focused on the treatment of cash as part of wider platform functionality.

The data suggests that advice professionals are much more concerned with the auto-sell down processes from wrappers to pay charges and advice fees, the insistence on minimum cash balances and the provision of wrapper-specific cash accounts.

The remaining 27% of responses here are split between info about rates, though it’s interesting that the highest selected must-have here was simply that a platform’s effective cash rate is positive, rather than the actual rates provided. This chimes with one of our main observations over the last year or so, that it’s difficult to compare the options out there without a degree in advanced mathematics, and simply rooting out those cash rates which aren’t net positive is a good way of cutting down the provider options.

Hopefully that’s your appetite suitably whetted for Soht Puhn. Platform subscribers will get this in their respective inboxes this week, and advisers will get an extract of some of the stuff on Analyser to help inform those platform due diligence exercises.

Finally, and for the first time in too long, I’m in charge of the jukebox. I saw this band recently tour a 20th anniversary of a record I’ve loved for 20 years too. Silhouette, by Thrice. It’s nice and loud.