Hi there TCWU fam, it’s Rich Mayor with the Top Class Weekly Update, stepping in while Mark’s off gallivanting somewhere or other. That means we’re diving into how platforms have fared in the early months of the year, with a special focus on the advised-flavoured ones.

Tax year end still has a certain magic for me. I can’t help but think back to the days of processing paper applications that arrived in massive postal sacks on bank holidays, and the joy of triple time afforded by those leaving things until the very, very last minute.

This year’s last-minuters had to contend with a wispy-haired, orange-faced curveball, as rumours of what might be included in a ‘liberation day’ on 2 April was announced to the market in March, and markets fell amid the speculation.

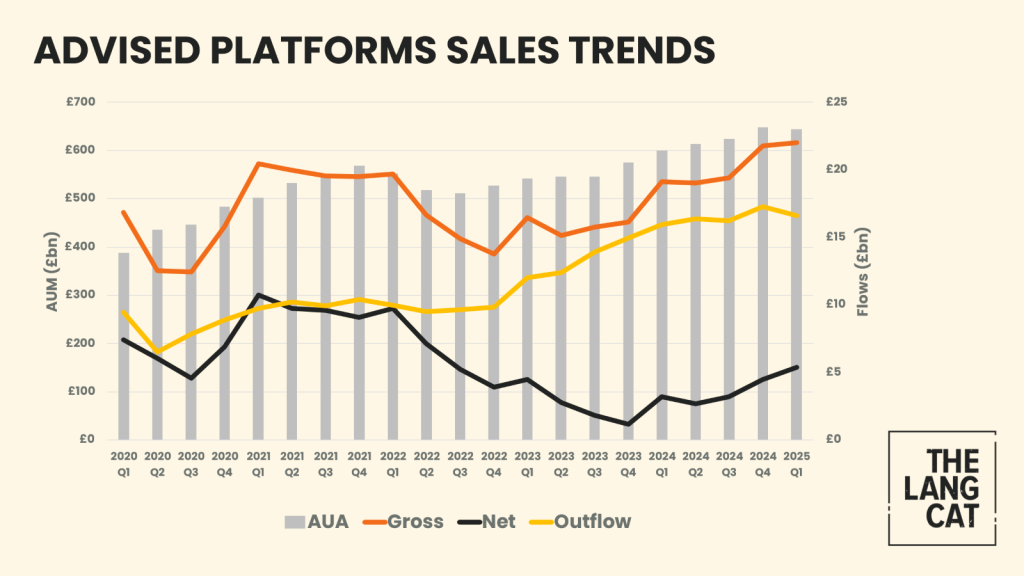

In the end, it might’ve meant a few investors ended up with more units than expected, but it also helped to ‘liberate’ the advised platform market of any quarterly asset growth in Q1 2025. See those grey bars tucked behind everything else in the chart.

In State of the Platform Nation 2024/25, we dug into how market movement has been doing most of the heavy lifting when it comes to asset growth in recent times, with net sales in 2024 struggling to make much of a contribution across the channel for the second year running.

A big part of why net sales have been so hard to come by is this… *points to that golden, yellowish line on the chart increasing*, but also… See that? *points to Q1 2025* Outflows have eased off after the Budget-fuelled rush at the end of 2024. That’s good news for advised platforms after a long stretch of brutal quarterly outflow hikes, and for Leith-based cats that said it would happen in Q1 2025.

That results in more net sales as we see *here*, on the black line of the chart. Clever folks (that’s you) would have already traced their finger across the screen to see that these are the best net sales we’ve seen for a few years.

Now, you’re probably thinking, “Bet he’s about to talk about that orangey line next.” You’d be right. New business coming onto platforms throughout 2024 was surprisingly strong, and just to save you more finger-tracing, Q1 2025 beats any quarter from last year. In fact, if we scroll even further back, and further back than this chart goes, Q1 2025 takes the crown for best quarter ever. Yep, better than anything from the record-breaking 2021, or even the giddy days of the DB transfer boom in 2017/18 where seemingly just about everything came onto platform.

The bulk of advised wealth is still firmly on-platform. Advisers told us in State of the Advice Nation Wave 7 that around three-quarters of AUM sits across primary and secondary platforms. The rest is split between off-platform providers and closed or legacy books.

But like some hungover chump being paid three times what he’s normally paid for a day’s work for what was essentially data input learned shortly after, you can’t assume that’ll be the case in the next year. You need to keep evolving and that.

Elsewhere in State of the Platform Nation, we look into how we’re seeing platforms become more… ‘lifelike’. There’s a new wave of smoothed managed funds gaining traction (and afforded a proving ground at the start of the year), plus some interesting innovations and tie-ups that are bringing annuity-style functions into the platform world, which all might prove prudent in growing assets through net sales in a market that will almost certainly be, uncertain.

That’s all from me, I think Steve is on duty next week. Or maybe he’s not. This is the wild and chaotic world we all live in.

All the best

Rich