Back with unpopular demand, it’s me, Rich Mayor, with the Update this week. That probably means that it’s time to see how platforms have been doing, but before that we have some important news for people turning on the Catwalk in June. That’s right, if you’ve not heard we’re doing the AdviceTech Catwalk again this year, as another cohort of applicants are put through their paces by our host of Inquisitors to try to win the grand prize… a pack of Rolos.

We’re pleased to announce that submissions are now open and close on 18 April, so get your proverbial skates on if you’d like to take part. Like last year, we’re looking for early-stage tech, in financial advice and planning, to show the New Things they have made to industry pros. We’re back at the Crypt we used for DeadX all those years ago, but upgraded to a full on church. Praise be. Natalie summarised the whole shebang nicely here.

All right, all right, all right. It’s that time of year again – when I stare at a bunch of numbers, stroke my beard, and try to make sense of the platform market. Q4 2024 was strong across the board for new business, though there was a brief spike in outflows around the Budget as some tried to get a sneak peek at what was in the briefcase. Some predictions hit, some didn’t, as predictions often do. But platforms we’ve spoken with all saw those outflows drop off significantly afterwards, and we’re still confident they’ll settle across the board this year, even with annuities likely to continue to feature more prominently than they have since I wore baggy jeans.

As expected, the platform market hit new highs in AUM in 2024, just like it does every year. Once again, pension flows were the key driver. However, Budget changes – both immediate and in 2027 – are set to reshape these flows and influence platform proposition development over the coming years.

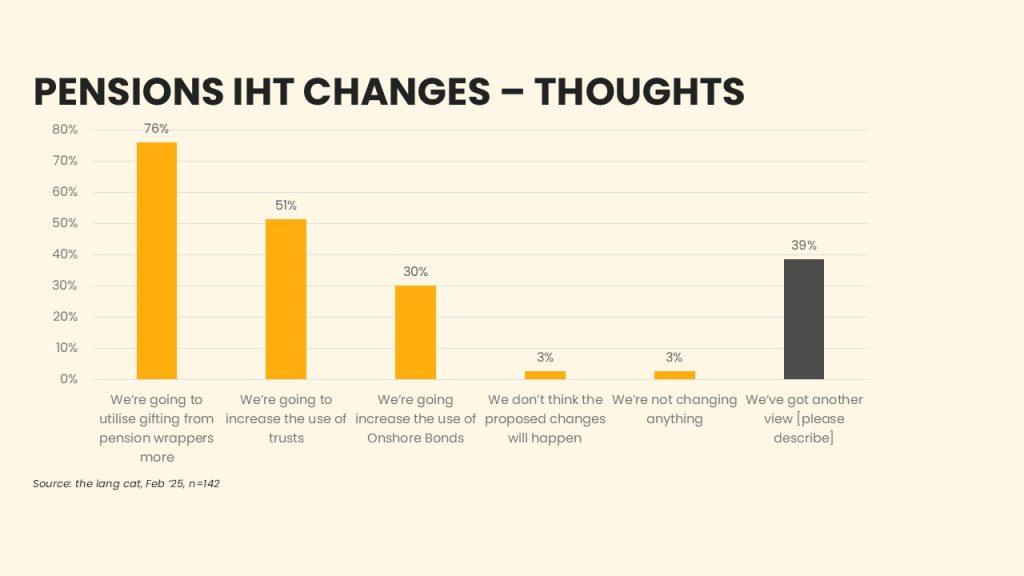

At the time of the Budget, we pondered that changes to IHT on pensions would drive more consolidation and increase outflows as gifting became more common. We also said (before it was cool) that CGT cuts would boost the number of bond wrappers on platforms, and that trend would pick up pace with the proposed IHT changes.

Well, Q4 2024 saw £760m of onshore bonds written onto platforms. A record quarter. While that’s a fraction of the £26bn in total gross sales, it’s more than double what we saw in Q4 2023. And based on what advice professionals told us last month, this trend is only going to accelerate in 2025 and beyond.

While there’s a cohort in the ‘we’ve got another view’ with plenty of different approaches, as well as plenty waiting to see what happens, that’s good news for platforms in terms of net sales. They’ve been pretty hard to come by since outflows started rising but bonds in their very nature are sticky products.

Advice professionals are also looking at trusts – sometimes in combination with bonds – to mitigate the IHT changes. Right now, about two-thirds of platforms offer a broad range of trusts (in both bare and discretionary flavours), though some only provide them through specific products.

Bonds, in particular, are more likely to be linked to platform. That’s all well and good so long as data and administration run smoothly. But I have a feeling there are still some gremlins lurking in the system.

Now that GIAs, pensions and ISAs aren’t the only dominant platform flows – in terms of net sales at least – issues like more form-filling, inconsistent charging structures and clunky, retro data sharing could start to surface.

Once upon a time I used to teach people about onshore bonds, top slicing and discounted gift trusts, but I’d be lying if I said it all came rushing back in November. If anyone’s like me, and you’d best hope you’re not, there’s likely to be some refreshing required at platforms. Everything’s cyclical though, I guess. As the final days of my thirties draw to a close, the baggy jeans I wore back in the day are trendy again, and the songs I grew up with are now considered “classics”.

So maybe it was only a matter of time before CGT and pensions’ fairly generous tax treatment got put under the microscope. But this also presents an opportunity – platforms can modernise even their less mainstream product ranges, rather than being dragged kicking and screaming into the future.

Markets change, trends shift, but somehow we always end up talking about the same things – just in a slightly different way. Or, as Matthew McConaughey’s character Wooderson put it in ‘retro classic’, Dazed and Confused “Man, it’s the same old thing, but it keeps getting different.”

TL:DR Outflows will stabilise. Bond use will rise. Platforms will need to adapt.

As you were then, sort of.

Finally, music choice for this week is a retro classic butchered by fun times cover band Me First and the Gimme Gimmes, with Where Do Broken Hearts Go?