Welcome to the middle of March, almost. March is a good month for a few reasons, in particular that the F1 season starts (back to Aus this year, phew), we tend to get the most sun since Christmas (I’m ignoring 2018 and you, Beast from the East) and it’s my birthday. This does mean I have to add another year on, but who’s counting.

Tomorrow (assuming you’re reading this on release day) also marks only twelve weeks to go until our second in what I’m sure will be a long-running series of AdviceTech Catwalk events. This has been punted in more than one TCWU already, but more details are out courtesy of Natalie, and so there’s a link if you want to read up on it and then come straight back here, please, once you’ve signed up to join us, of course.

There’s been a LOT written about the use of AI across all of financial services, and you would be forgiven for maybe switching off a little as similar discussions are had in meetings, at events, and over dinner and drinks up and down the country. Hardly a minute goes by without OpenAI releasing a thing, Google maybe doing it better 5 minutes later, and then Elon immediately doing something wild and whacky with Grok to try and keep up.

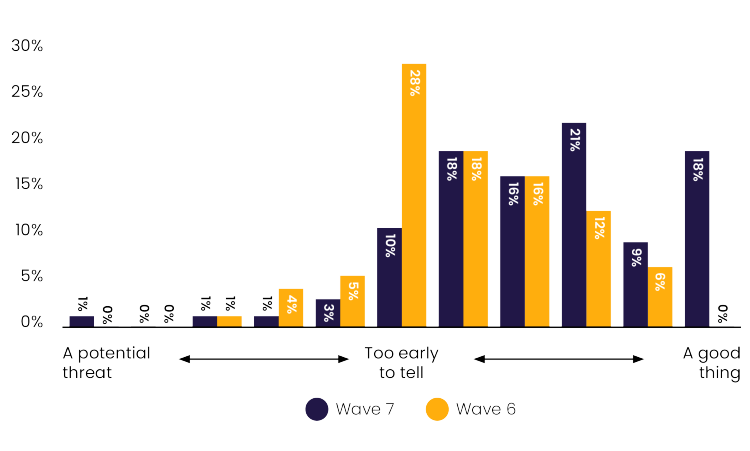

But beneath the headlines and online banter, as advisers, platforms, investment managers, and product providers try their hardest to enhance efficiency, improve client experiences, and stay ahead of the competition, AI (in whatever guise you need it to be) has become a must-have tool. Many of you will have read in our recent State of the Advice Nation (SOTAN) report that almost most no-one now thinks that AI is a threat to what they do, rather they are embracing it more than ever.

AI TECHNOLOGY: A THREAT OR A GOOD THING IN RELATION TO YOUR FIRM?

This sentiment is only present because there really are some great bits of kit available that can save us all time and effort, and free us up from the frustration of having to repeatedly carry out monotonous tasks. But how can this undulation of new new tech be used safely, and indeed ethically, and how could / should it be regulated? This is a rhetorical question for now, although I will be taking questions at our event in June.

Only yesterday, the FCA and ICO announced they’d be hosting a roundtable to discuss AI adoption and innovation, highlighting the growing interest and investment in AI technologies among UK adviser firms. According to a report by the Bank of England and FCA in 2024, 75% of firms are already using AI, with a further 10% planning to adopt it within the next three years. Our own research, again from February’s SOTAN release, is a bit more cautious and shows that just under half of respondents will be using AI in their businesses by the end of this year; but this number has grown by over a third since last year. Whatever the actual figure is, the regulator is taking more and more interest in the subject, and so be prepared to receive one of their famous questionnaires very soon…

Despite the obvious advantages, AI adoption is not without its challenges. More of our own stats (sorry, not sorry; we do a lot of research) highlight a mismatch between the confidence of UK financial services business leaders in their readiness for AI and their actual plans for effective implementation. Many firms are maybe also grappling with understanding the complexities of AI technologies as they want to, and indeed must, make sure they are used ethically and responsibly.

What’s absolutely essential is making sure there is thorough and relevant due diligence conducted on your choice of AI technology provider before simply plugging them in. Transparency and accountability are crucial to maintaining trust, and so for all firms, this will mean making sure you can explain why and how AI is being used to your customers, who may well take a cynical view themselves. Firms must strike a balance between leveraging AI for efficiency and maintaining the personal touch that customers value.

Ultimately, we are all responsible for making sure AI is developed and used in a way that is fair, transparent, accountable, and has respect for human values. Ethics 101, right there.

And your music choice this week is a really rather excellent acoustic cover of the Guns ‘n’ Roses classic Patience, sung by the also rather excellent Chris Cornell (RIP). Soundgarden was a big part of my A-level years and I even still have a few vinyls to show for it. Those and a Green Day brain shaped CD. Who knew.

So, that’s me done. Our own acoustic expert, Rich Mayor, will be with you next week to reveal all the latest platform stats.