Well, that was an exciting last 7 days, wasn’t it? Putting this weekend’s rugby and it’s well documented range of controversies aside (particularly if you’re Scottish), it’s been very almost a week since our REGENERATE 2024 #langcatlive event at the fantastic venue that is London’s King’s Place and I think we’ve all just about recovered! If not, Half Term is a perfect time to…no, wait, I can hear a loud person downstairs complaining “I’m bored” for about the 1000th time, the (#offbrand) dog is barking to go out, and apparently someone didn’t get enough pancakes last night thus I’m going to have to whip up another batch of batter. So, that’s all going to need taking care of first.

If you couldn’t join us last week, we’ll be doing it again for sure, so you’ll want to clear your diary for early February 2025 in anticipation of next year’s extravaganza. We’ve had loads of great feedback from attendees, in particular for having both the Pensions Minister and the FCA on stage in the same day; and how people just don’t talk about bonds quite enough. And that was before the funky coloured cocktails provided by our friends over at Nucleus – see above reference to recovery.

You can read all about the day itself here, including the launch of our latest State of the Advice Nation (SOTAN) research, and you’ll also want to find out more about what we have coming up later in the year, so get yourself signed up to find out more about all our events here.

Lots stood out for me (of course, it was all brilliant), including the session on Artificial Intelligence, which contained some very differing views on how we should adopt AI within financial services, and a few warnings about the risks it brings. The subject came up again briefly when Kate Blatchford-Hick from the FCA talked about what the FCA is up to right now, but we’re a principles-based industry, so we know that we’re going to be left to our own devices when it comes to working out the right way to use it.

The real-world application of AI is complex, no matter what type of business you work in. I think we can all agree that a robot (no apologies for use of an over-simplified term that could well get some people riled) is never going to replace a planner, or a tax expert, or a kind voice on the end of the phone when a customer on the other end needs something a computer just can’t provide. But what it can certainly help with, is freeing us all up to spend more time on the things we care about and that really matter. I say let the robots do all the boring stuff that no one really wants to do anyhow, and we can get on with making the industry a better place.

In other news, not a week seems to go by without hearing about another merger or sale, and this week it was the turn of Nucleus (again) when they announced they had acquired the technology firm Third Financial. This one’s a particularly interesting move as their new FNZ platform isn’t quite live yet and now there’s a completely separate bit of tech over there to be thinking about. Third Financial itself has some pretty impressive clients and some decent AUA in the bag, so there’s the scale game to think about, but Nucleus already has around £80bn on the cards, so there has got to be something else in it. Their newfound ability to offer a whitelabel or adviser-as-a-platform solution is going to need to develop fast to provide proper challenge to the likes of Seccl and Intelliflo’s new (but not quite live) Wealthlink offering in conjunction with Hubwise.

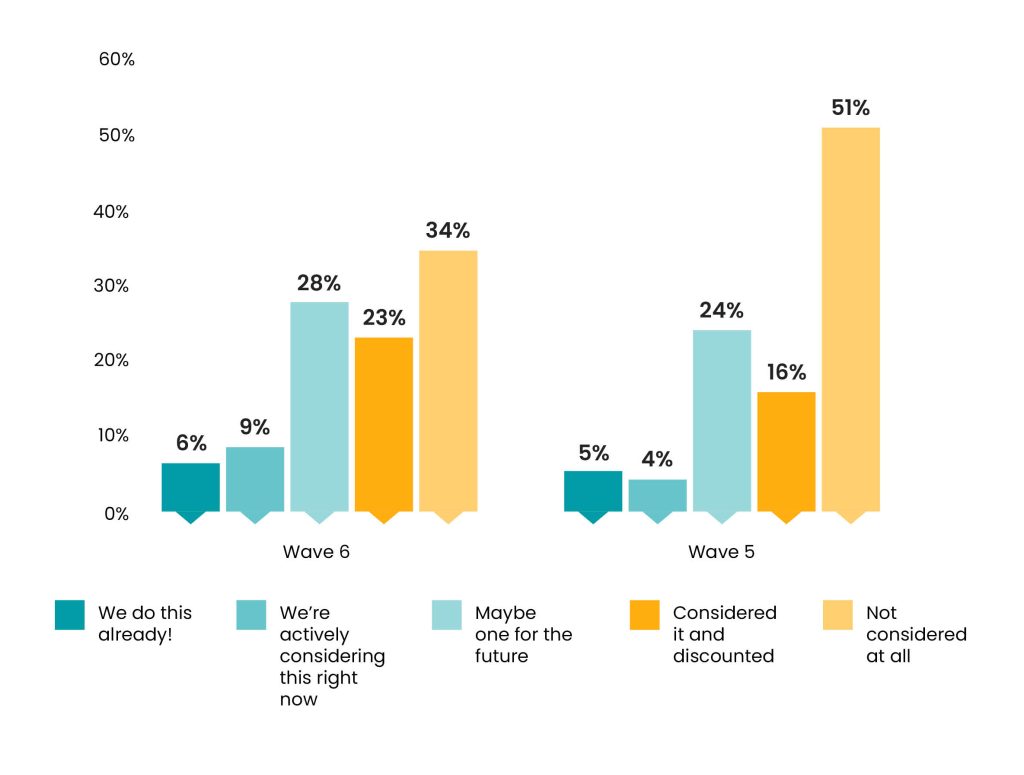

To link nicely back to SOTAN, we’ve been asking advisers for their views on the adviser-as-a-platform model for a couple of years (see chart below), and this year’s survey shows that those who already do this or are actively considering it has grown by two thirds since last year. However, the number that have considered but then discounted it is up almost half on 2023 (albeit from a higher base). We shall watch with interest!

That’s me done, so I’ll dig out the candles (and a grovelling apology for forgetting to buy a card… again) for later, then settle back and wait for the ‘constructive feedback’ on my song choice.