Hi gang, Rich Mayor here to talk about the third quarter a bit. We’re tantalisingly close to being able to talk about everything about platforms’ numbers last quarter, but we’re still embargoed until Thursday when it will be unleashed upon an unsuspecting public (that’ll be you). But while we can’t say everything we can say something. That is despite my Mum’s best advice of not saying anything at all if you can’t say something nice.

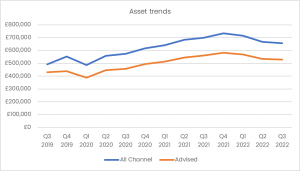

First off, asset growth, or indeed a distinct lack of it. Across all channels assets are down a smidge (1.36%) on last quarter’s totals, which doesn’t sound like a lot, but this has been the third consecutive quarter of falls which combine for the grim stat of £76bn being wiped off platform asset values since the end of 2021. We are now at a similar level to the numbers we saw in the summer of 2021.

To give an idea of the impact of this on platform revenues (at least those generated from percentage charges on assets, i.e., every one), if that £76bn was all charged at 0.25% (which it won’t be) that’ll be £190m in revenues (which it isn’t). Aside from some fixed product charges and other bits and bobs, most of the charging is ad valorem, but I suspect some will be dusting off the fixed-fee model dossiers from circa 2015 to see how they could complement ad valorem charging. Or perhaps in a decade of assets going up-and-to-the-right of the graph, a significant rainy-day fund is ready to help out. Unos.

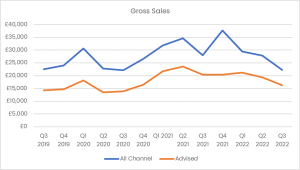

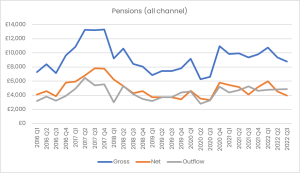

So assets are looking dicey, but the also-not-good-but-consistent news is sales are down too. Absolutely unsurprising given… um… everything, is that gross sales are down, chiming with the majority of conversations I’ve had with advisers over the last few weeks. It’s a familiar equation: volatile markets = >(time reassuring clients), and, <(time placing new business).

With assets and new money coming on to platforms declining, it’s fair to assume that net sales are going to look bleak. And yes, that is the case, but there’s a little more to unpack, namely the rate of outflows, in the name of context. (Next graph, please.)

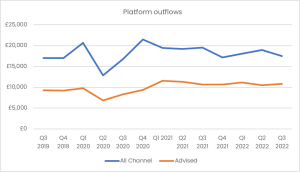

There’s some solace in seeing that outflows are remaining steady in volatile markets (though we’re not privy to how much of this is in the form of client money, and how much is going elsewhere), in the sense that customers aren’t crystallising their losses, but the competition between platforms for at-retirement business has that consequence: they are at-retirement and taking an income that needs to be paid whatever the weather – as we’ve seen since Q4 2021 in particular.

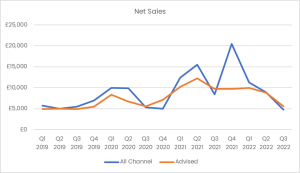

Which rounds us off nicely to look at net sales, which are again at pandemic levels. But aside from the totals, there aren’t too many other similarities. When we were in the pandemic, there was a silver bullet to opening up the country in the form of a vaccine. We were still in a low interest rate environment and some households were actually saving money from commuting and the other frivolities that being outside generally afforded. That resulted in a record-breaking year for investments on platforms, but won’t happen when we escape this crisis. It’s going to be a slow recovery.

From an optimistic viewpoint, innovations can often come from tough times and don’t be surprised to hear of new markets and avenues explored by platforms to help tackle this environment. Though I’m kind of thinking I should’ve heeded my mum’s advice.

TL;DR: Platform net sales are low because gross sales are down and outflows are steady – at least for now.

LINK ME UP, SCOTTY

- Platform private-labelling or the adviser-as-platform model remains a hot topic, and this large consolidator isn’t ruling it out.

- When not mucking around on guitars, our own Mark Polson found time to do a session on Consumer Duty at the PFS Festival last week – communication, communication, communication…

- The podcat is back – Tom’s guest this week is Edi Truell, co-founder of the pensions consolidator the Pensions Superfund. Fascinating listen.

- Music choice for this week is punk/thrash band from the States, the excellently-named PEARS. Think I’ve been a bit safe with my choices now, but this one will blow the cobwebs off.

Thanks for reading,

Rich