Hello there!

Rich Mayor with the Update this week as Mark is somehow still relaxing somewhere in the continent, this time in his natural habitat, serenaded by heavy metal tones and death growl vocals. Pretty much the same for me in the South Coast of England, which has been balmy, and I’ve been fortunate enough to be forced to shut all the windows while I too am serenaded by builders smashing the living hell out of the outside of my house all week.

No rest for the wicked and all that, and as is de rigeur for my updates, we’ll stamp your ticket stub for our 5,876th visit to Platform Land. Tantalisingly close to the milestone 5,877th visit and your free henna tattoo of your favourite MPS, and choice of any API from the middle row.

ADVISED PLATFORM LAND

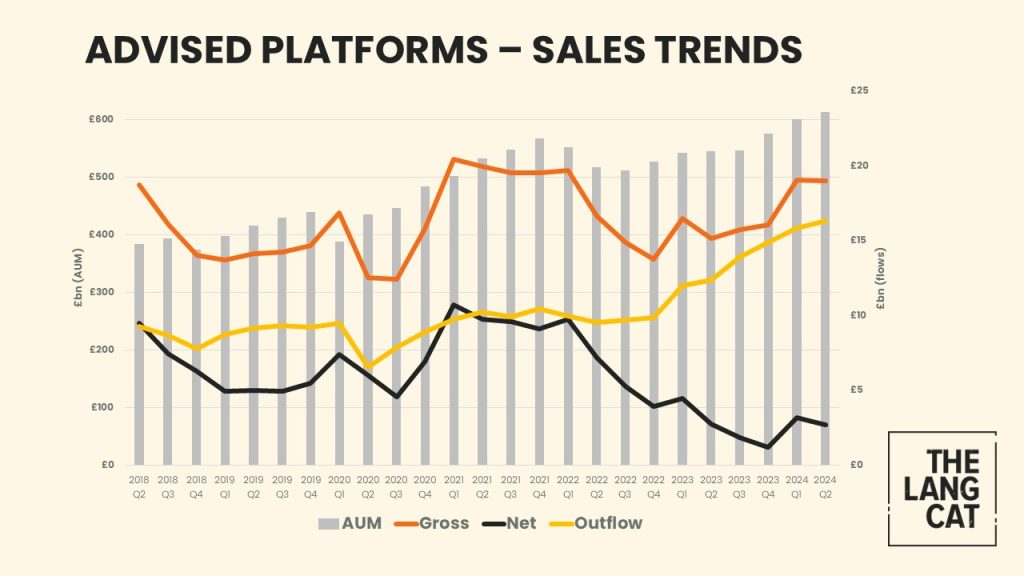

Some individual platform numbers are still under embargo so we’ll talk at an aggregate level for the advised channel. From an asset growth perspective, it’s quarterly growth akin to the summer in the UK, where stuff kind of just ticks along. Gross sales are more representative of the time just before, and the rush to get all the work done before swanning off to sunnier climes.

Gross sales were surprisingly strong in the first few months of the year, and that’s been backed up by strong sales again in Q2. Though it’s worth bearing in mind that transfers between platforms are included as gross sales, and if I was to hazard a guess, I’d say around two thirds of that just-about-£20bn number is simply business moving from one place to another, and not new, fresh cash.

That’s why so many platforms use net sales as their barometer for success, but they’ve been pretty tricky to get hold of for the past couple of years, due to that yellowy-gold line of advised outflows which have risen for eight consecutive quarters and are now about double what we’d see each quarter before.

There’s not too much new stuff to say about outflows, advisers are telling us it’s all for the same reasons: paying off mortgages, increased use of annuities, helping out family etc. but the question is naturally where the zenith of platform outflows is and what will happen afterwards? With a recent interest rate cut and hope of more to come we may have just about hit the peak, or slowed the escalation of outflows, but it’s doubtful the outflows will fall back to the levels before for a long time yet, if indeed they do ever.

D2C ZONE

But the big news comes in the D2C area of platform land, in the sale of Hargreaves Lansdown, for a whopping £5.4bn. We interchange millions and billions a lot in this industry, but to give a different lens on the price compared to platformy deals gone by, that’s more than three of the biggest deals for True Potential, Brewin Dolphin and interactive investor combined (and with probably enough change to fund the deals for James Hay, M&G Wealth and Cofunds).

It’s far and away the biggest individual platform deal we’ve seen, but it is for the largest D2C platform around. Historically there’s not been anyone even remotely close enough to eat any of its rather sizeable lunch, but you need only look to see numbers posted by the likes of interactive investor and AJ Bell, and the quite remarkable growth of Vanguard’s platform to know the landscape is considerably different to when HL was pretty much the only game in town.

There’s extra impetus and incentive here for D2C providers in the FCA’s considering to bin off simplified advice and keep targeted support, which seems a sensible if perhaps not unexpected resolution. In our Advice Gap 2024 paper (download for free here) the research showed little to no appetite from firms to offer the service. The historical concerns around providers poaching clients by getting involved with advised clients is much lessened in the Targeted Support parameters too, with over two thirds thinking Targeted Support wouldn’t be used by their clients, and less than 20% seeing it as a threat.

It does present a significant opportunity for D2C firms to help more clients and will provide the clarity to inspire confidence in staying within the Targeted Support boundaries. Indeed when the lang cat’s Big Tom (McPhail, as opposed to Ellis) chatted with Nathan Long of Hargreaves Lansdown on the Podcat last Christmas, Long mentioned HL were already exploring this.

That’s enough chatter from me this week, and I think Polson’s back on it next week after chilling out in Estonia (and Finland I think) watching metal. I’m off for a relaxing evening of football where *checks notes*… Portsmouth welcome Millwall.

Music choice this week was never gonna be quiet. I’ve had the riff to How Do We Know by Aussie rockers The Living End stuck in my head for about 37 days. So now you will too. Warning: absolute banger.