What up, took-woo (TCWU) fam. It’s me, Rich Mayor, sporting a moustache for Movember that’s definitely in the ‘dodgy’ phase (if you’d like to donate, here’s our team link). I’m on the Update this week which can only mean one thing, there’s potentially something interesting to write about platforms.

There are some things we can unpack about the third quarter platform numbers. With the usual proviso of ‘embargoed data so we’ll only talk at an aggregated level’ – you’ll have to wait until Friday for any individual platforms sales data – there are some #quiteinteresting findings at said aggregated level.

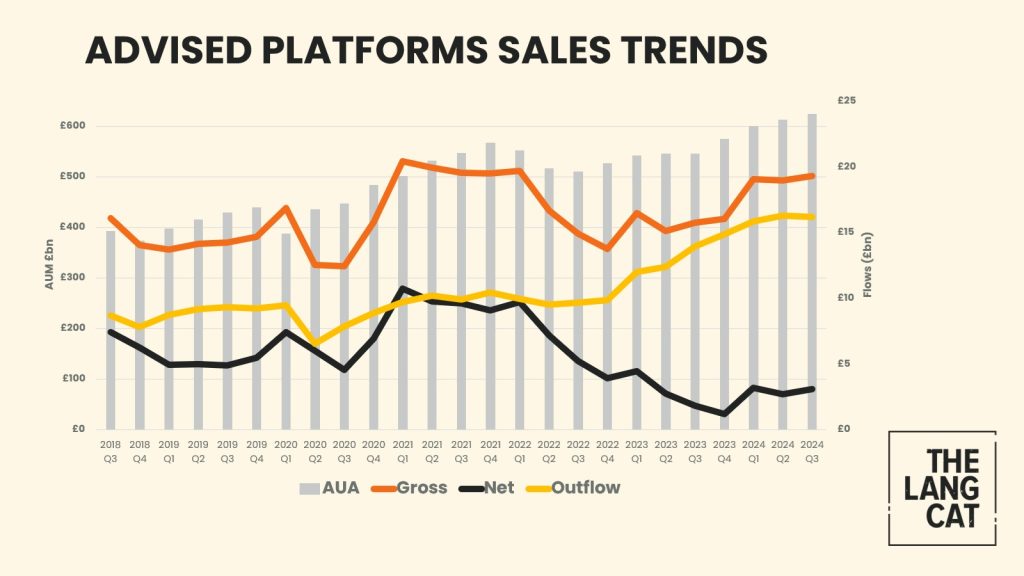

The first quite interesting thing is that things haven’t really changed from quarter to quarter this year. Advised AUM is up around 2%, roughly the same as last time out. Gross sales are up a bit on the previous quarter, and net sales are up a bit more.

All right, it doesn’t sound all that interesting, but the big news – as you may have deduced – is that after eight consecutive quarters of increases that effectively doubled the quarterly rate we’re used to seeing, outflows came down. A little bit. Just about enough to be able to see on a graph if you squint at it. But it feels like the biggest little news in a while, and while one quarter maketh a summer it does not, this is welcome respite for some advised platforms whose brows have been more and more furrowed through each of those eight quarters.

It’s also good news for Leith-based financial services consultancies who said (guessed) that last quarter was probably the peak [insert hilarious broken clock remark]. This may prove to be short-lived, as plenty of platforms have been telling me there was an increase in pre-Budget tax client withdrawals. Depends how much of that is cancelled or is put back in I suppose, but for this guy, he’s thinking it will be quite nice to not talk about outflows so much.

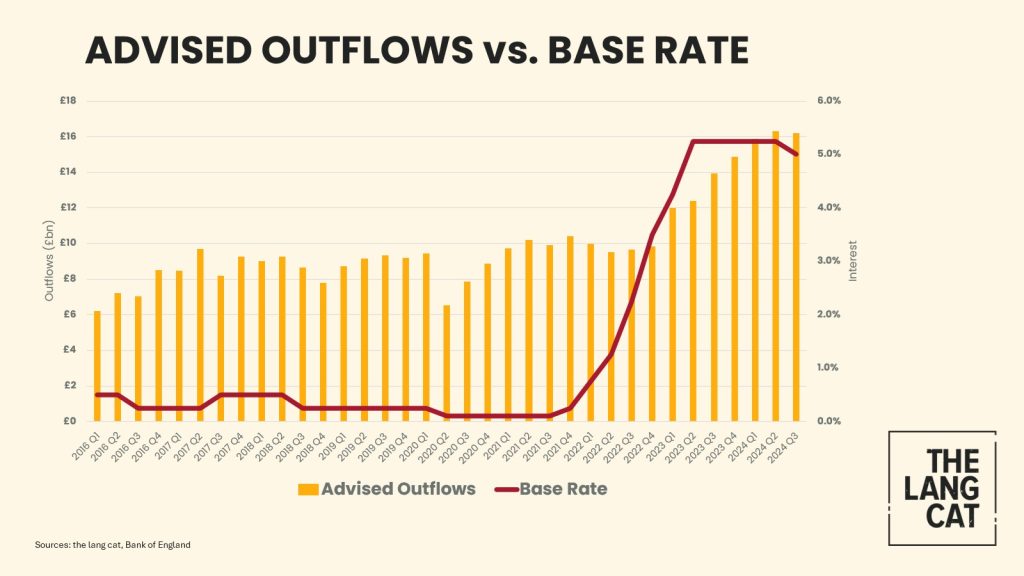

Anyway, outflows. When looking at the new highest-ever quarterly outflows, north of £16bn in Q2 2024, we were in a time of potential interest rate cuts as things were getting more expensive at about the rate the Bank of England thought they should. In this high interest rate environment, the knock-on effects for advised platforms had been that traditionally-not-platform things like annuities were looking rather appealing, and that investors with mortgages with deals ending may consider paying them off after lifting their jaws from the table following receipt of the new repayments figure.

We’ve had not one but two rate cuts since the last time I was harping on about platforms, and one of them is reflected in the chart below. The red line and the yellow/orange bar go up around the same time and come down around the same time too, which is the type of devastating insight we’ve been providing the industry for years.

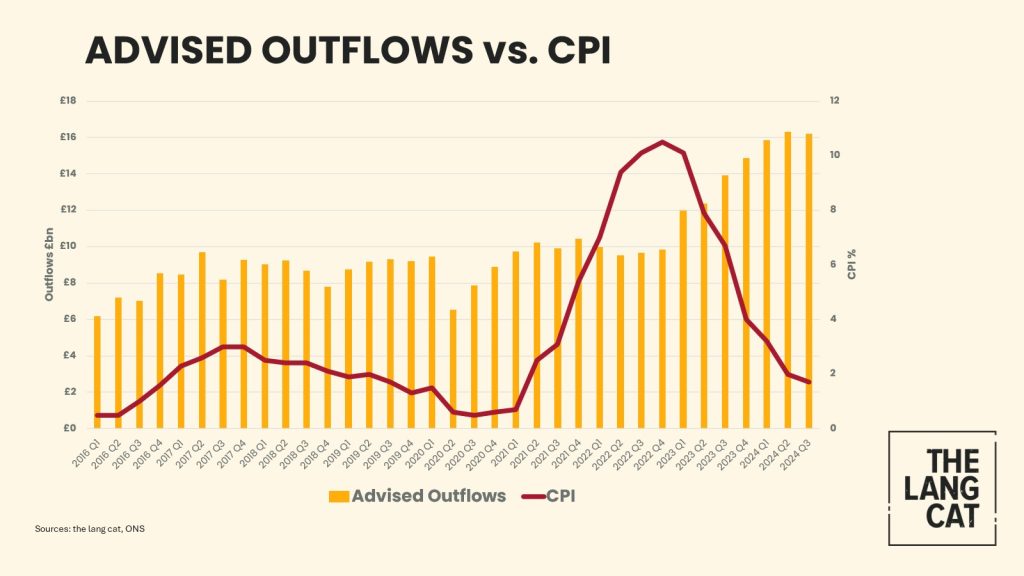

Outflows to products that are more competitive in a higher interest rate environment as well as the mortgage bit were two of the main reasons advisers have given us for increased withdrawals that are linked to interest rate rises. The other main reasons were linked to things being more expensive due to inflation, and this next chart shows the same yellow/orange bars against inflation. I’m sure that’s enough about outflows.

Anyway, the big question is where outflows might settle after just about doubling? To predict (guess) this, might I draw your attention to the far left of the previous chart. Outflows steadily climbed throughout the DB transfer boom in 2017 and 2018 which while was fill your boots season for many platforms, the type of business coming on was at-retirement business which means raising the rate of outflows each quarter. Pensions make platform prizes, as the old adage goes, and that means platform growth is often dictated by the regulation and legislation that goes along with it. Enter Rachel Reeves and the red briefcase.

Inherited and unspent pensions are being brought into the inheritance tax regime from 2027. Though understandably there’s a whole lot of detail to be ironed out here, we think broadly this means that there’s extra incentive to consolidate existing pensions to help cut down the work for beneficiaries but also that it will likely result in higher outflows as it becomes a less attractive vehicle for passing down wealth to others.

It’s logical to think some pension assets will be gifted (helping out family members was one of the other main reasons advisers gave us for increased withdrawals), and that some will move into platform bonds, as well as an increase in trust planning (possibly inside a bond too), and finally of annuity usage (so long as still competitive). The latter moves AUM out of the percentage-based charging models for platforms and advice firms, and we expect there to be an increase in fixed fee charging for advice firms as a result. And that, dear readers, is enough about outflows, and enough from me.

This week’s music choice comes from Midwestern American band The Menzingers, America [You’re freaking me out].