Hello everyone, happy end of August.

It’s been a while, and I suspect this might be due to a) my ‘eclectic’ music taste, or b) mince pie-gate; or maybe both. But either way, everyone else is busy rehearsing in a basement in the West Country (Consumer Duty are going on the road, it seems) or writing a couple of spiffing new reports we’re working on with such vigour that they need to get onto Amazon to order a new keyboard as sparks are coming out of the old one. So you get me, but in a nice way.

Everyone always says that “August is always a bit quiet”, or “Everyone’s away and so I just can’t get anything done”. But I find this generally turns out to be not the case; rather because lots of people are away, us poor sods who get left behind are full steam ahead and really are glad they have Prime. For the keyboards.

We’ve covered service in a variety of ways over the last couple of years, with our paper published in conjunction with Parmenion last year one particular example (see the #Links for how you can get involved this year). And our autumn 2023 paper with Royal London widened this out to cover Consumer Duty – whisper it as you try not to think about the beach, pool and a glass of something refreshing; but not the queues to get back onto the mainland. We’ll be publishing plenty more in this area throughout the autumn and are awaiting what could possibly be the FCA’s first efforts at calling out, or maybe even fining, a provider for not hitting their 12-month reporting deadline over the summer.

The tenuous link here is to enable me to mention the NHS, in particular the RUH in Bath, whose service has been excellent in seeing me through a troublesome few weeks, this due to me being a plonker and breaking a really rather useful limb about a week before I moved house/went on holiday, and having only last week got my cast off #notverypopularinthehammondhousehold. I could mention the rather opposite experience I’m having with my travel insurance company, but I’d really rather not.

When we ponder on service, we might automatically think of a provider; so a platform, or large insurance firm, or quite possibly the bank we’ve used since we were a student. Brand loyalty is a huge business (even with the NHS), and it’s why banks in particular offer railcards and sizeable, free overdrafts to students – an easy way to capture your business for the decades to come.

But it’s often the advisers in our industry who are at the real forefront when it comes to service, whether that’s doing what advisers do, or maybe a few things a little bit different. Without advisers giving advice, a lot of those big providers wouldn’t have any customers in the first place. And I’m deliberately excluding robo/hybrid/augmented ‘advisers’ here, some of whom have found themselves in a plaster cast that’s never coming off.

We’re shortly (well, October) going back out into the field with our big, annual State of the Advice Nation (SOTAN) survey. Lots to keep keeping track of in terms of service in what will be the 7th issue, but also a load of tweaks and brand-new stuff we’ll be including. Kate and TV’s Steve Nelson (remember him?) are in full on design mode, so if there’s anything you think we should be including, get in touch.

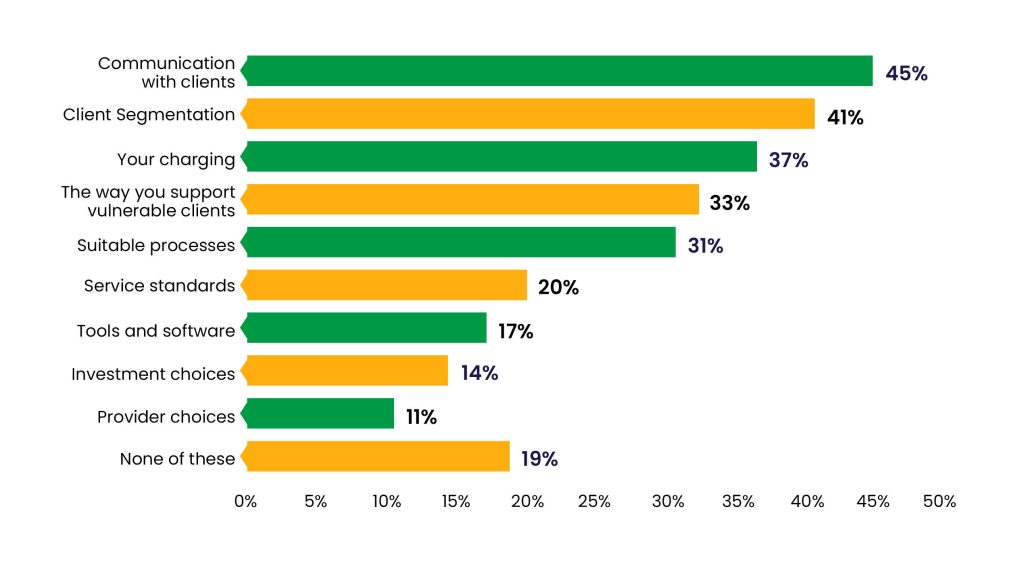

We’re asked with increasing frequency about our views on how tech influences service across the whole of financial services, but almost daily about the importance of people. The chart below, extracted from this year’s SOTAN released in February, shows quite clearly that advisers fully understand that they need to focus on how they deal and communicate with their clients, more than the technology or investment choices available to them.

Q: Which tangible changes has your organisation made to meet the Consumer Duty requirements?

Technology is still very important, as without it our industry could be even less efficient than it sometimes is, but any adviser worth their salt will have been focusing on pretty much the same things before Consumer Duty became the buzz word that it now is.

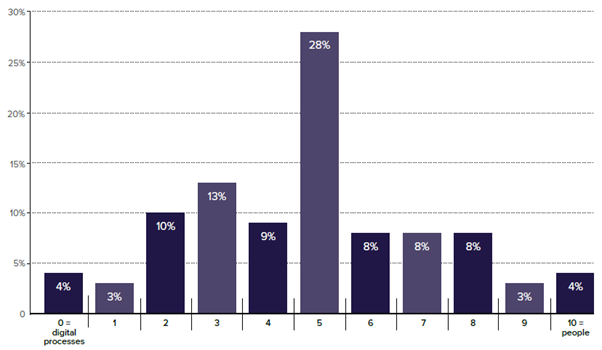

This next chart, most recently featured in our annual State of the Platform Nation (SOTPN) report, shows that most advisers would invest in a combination of both tech and people when it comes to improving the world of platforms. And there’s some obvious read-across into almost any industry.

Q: Where 0 = a focus on digital processes and 10 = a focus on people, where would you invest?

So, if it’s not already obvious and I haven’t drummed it home enough, always ensure servicing the customer (preferably in new ways, alongside the use of innovative tech) is the most important part of what you’re doing. Otherwise, you could easily end up in a permanent cast.

On to the music… and I’ve been influenced by AI, would you believe! Copilot has been having an off week as when you say “SOTAN”, it hears “sultan”. So, you get Sultans of Swing by Dire Straits, which I reckon will about pass muster with not only most cats (well, maybe not the Boss, cos that’s asking a little too much) but also this audience. I hope you like it.