By Steve Nelson and Rich Mayor

SOTAN, for the uninitiated, is the lang cat’s biggest report of the year.

It used to be called State of the Adviser Nation and now it’s called State of the Advice Nation, which is the kind of lazy rebrand we can get on board with.

But there is a serious reason behind the rebrand too. We’ve made a thing about SOTAN reflecting the views of everyone in the profession, not just advisers and planners. So whether you’re in paraplanning, ops, compliance or admin, you’re welcome to take part in our stuff. But in all honesty, we’ve done a bad job of executing that. This is the first year we think we’ve addressed that.

So now if you’re an adviser or planner, you turn a certain direction in the survey. If you’re a paraplanner, you turn in another direction. And if you’re a business owner, you were exposed to a different set of questions as well.

We still explore all kinds of dynamics in SOTAN, including questions on how you view yourself in terms of technology expertise, diversity issues in the sector, growth aspirations, and much more.

There’s so much data in the report that we can’t possibly hope to cover it all in this summary, but there are a few things that initially struck us from the results:

#1 The state of the paraplanning nation is… surprising

Our dedicated paraplanning section of the report both reinforced findings from previous work but also slapped us in the face in equal measure.

Over the past year we’ve done a lot of work on servicing. We’ve interviewed a shedload of members of the advice profession to understand what service means to them, and had a go at quantifying the impact of poor service. We’ve even looked at the process around letters of authority (God knows how you cope with this).

As researchers you’ve got to check your biases at the door. But while with some questions you expect a certain outcome, some questions yield answers you are simply not prepared for. This was one such question.

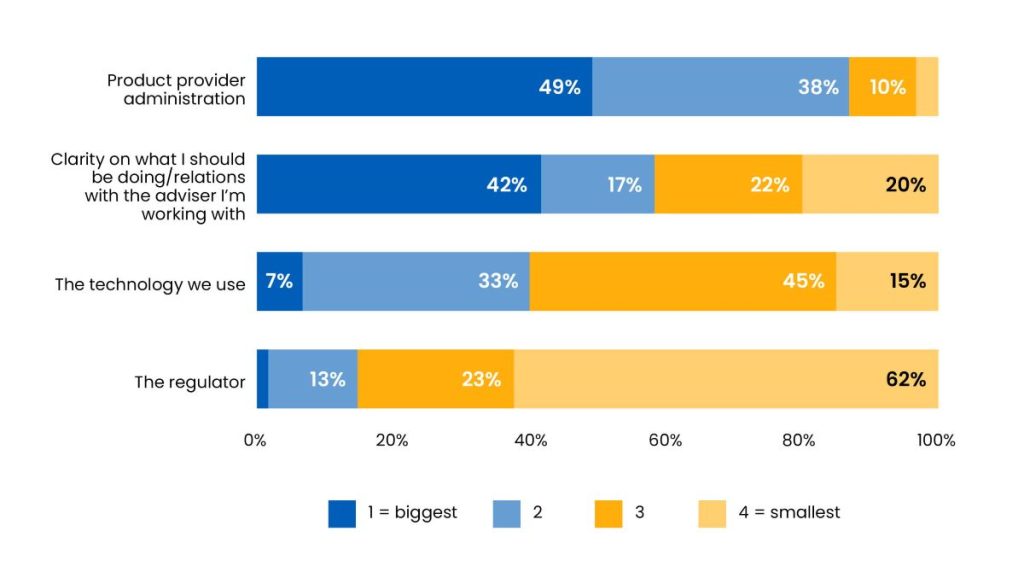

We asked the paraplanning profession: What is the biggest inhibitor of your day-to-day working life?

No prizes for that top response – product provider administration. We’ve got almost exactly half of the responses saying provider admin is the biggest obstacle in paraplanners’ working lives.

But take a look at that second response – clarity on what I should be doing/relations with the adviser I’m working with. This is both in-house and outsourced paraplanners saying that the biggest inhibitor to doing their jobs to the best of their ability comes down to interpersonal stuff, and the communication between paraplanners and advisers. That was a huge surprise to us.

#2 AI in advice is here already

At the end of a study we’re sometimes left with a bit of buyer’s remorse, and wishing we’d asked something in a better or different way.

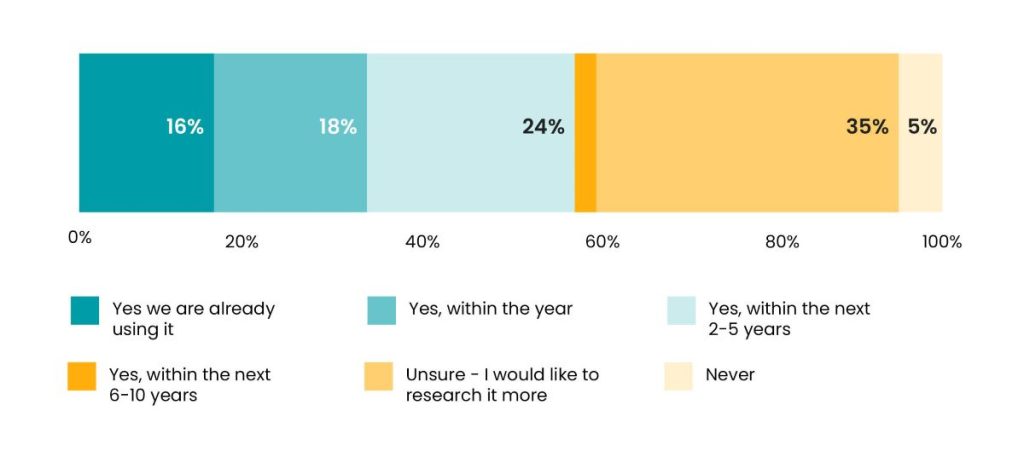

We’re interested in the adoption of artificial intelligence within the sector, so we asked: Will you consider incorporating AI-based technology into your advice process?

Here we see that 16% of you say you’re already doing this, and 18% say they’ll be doing it within the year. We just wish we had a follow-up question to see exactly what does that mean? After all, autofill-ing dates on Excel is a kind of AI. Or are you actually using AI technology, and if so, how?

We dedicated a session to the topic of AI at our #langcatlive Regenerate event last week, and we’ll bring you the video of that as soon as it’s ready. But this is definitely an area, like our response categories, where we’d like to research more.

#3 Change is possible

ESG has sometimes been deemed a passing fad, and commentary in recent years has suggested that interest in sustainable investing might be waning. So we thought we’d test that.

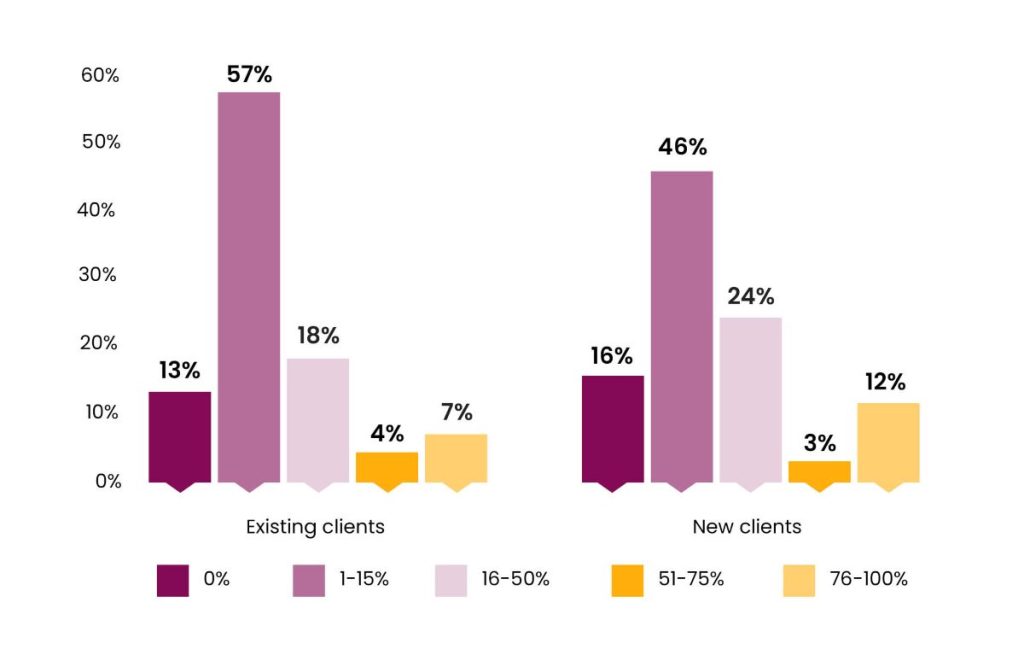

We asked business owners about the proportion of clients (existing and new) that are in ESG or similar solutions. What’s interesting is how few responses were in the ‘zero’ bar – 13% with no existing clients in ESG solutions and 16% with no new clients in ESG solutions.

This means a sizeable chunk of clients are in ESG solutions. Based on at least 15% of clients being in these propositions, it averages out as 19.1% across all respondents for existing clients, and 23.7% for new clients.

You can read these findings in a couple of ways. Firstly, while we don’t know how this translates to assets, ESG investing seems to represent a significant amount of advice fee revenue, platform charges, MPS charges, and generally the whole total cost of ownership.

Secondly, there’s a wider perspective, and one that goes beyond purely ESG. There will be some understandable scepticism about the extent of greenwashing and mislabelling that goes on, and the difference between say, impact investing and something that’s called ‘ESG’ but isn’t really.

For us, what this data tells us is that when you have the political will, the societal will and the regulatory will, we can fundamentally change things.

We saw the same thing at the start of the pandemic, where we were able to move away from wet signatures to digital ones when we absolutely had to. So when the will is there, we can change things. But it’s the question of how to drive consensus when we’re so fractured, when we’re all running our own unique businesses – that is the challenge.

So those are a few of our SOTAN highlights.

If you subscribe to our stuff or if you took part in the survey, you’ll have received your full copy of SOTAN already.

If you’re part of a larger organisation that works with the advice profession, get in touch with the insight team for how to get hold of a copy, and how we can best support your business.

And if you’re a member of the advice profession and want to participate in stuff like SOTAN in future, the way to do that is to join our 1,400-strong lang cat panel. We love hearing from each and every one of you.